Dealing with supply chain uncertainty has made finding that balance between low cost and available product more difficult than ever.

Last week, the Institute for Supply Management’s monthly Manufacturing ISM Report on Business noted the manufacturing sector continues to expand, although The February PMI registered 50.1%, down 0.8 percentage points from the January reading and just barely above the 50 threshold that indicates expansion versus contraction.

Respondents referenced growing uncertainty. “Coronavirus is wreaking havoc on the electronics industry. Companies are delayed in starting up production, which is resulting in longer lead times, constraints and increased pricing. It's a mad dash to dual source stateside in case China isn't back online soon,” one computer and electronics product sector respondent said.

Also see: “Will the COVID-19 Coronavirus Infect the World’s Supply Chains?”

No matter the market conditions, your business dynamics haven’t changed; you still need to buy products from your manufacturing partners at costs low enough to sell them at a profit to your end customers. My MDM colleague Derek Green and I have worked many years in distribution category management. We have a “do now quick fix” list that you can use when you are faced with supply chain disruption.

Quick Fixes to Mitigate Your Supply Chain Risk

1.Don’t work in a vacuum. Talk to your manufacturer partners about the supply chain challenges you both are facing. Your manufacturer partners are facing the same issues and communicating with your key strategic suppliers about first-time fill rates and back orders is critical to your success. There is a reason you both measure first-time fill rates and back orders so closely. When you see the number of back orders climbing and dropping first-time fill orders rates for one of key manufacturers, don’t wait. Act quickly and get ahold of them and find ways to address it together. Out-of-Stocks drive your mutual customers to competitors. Your strategic suppliers don’t want that to happen. It’s a lose-lose for both of you, so work together.

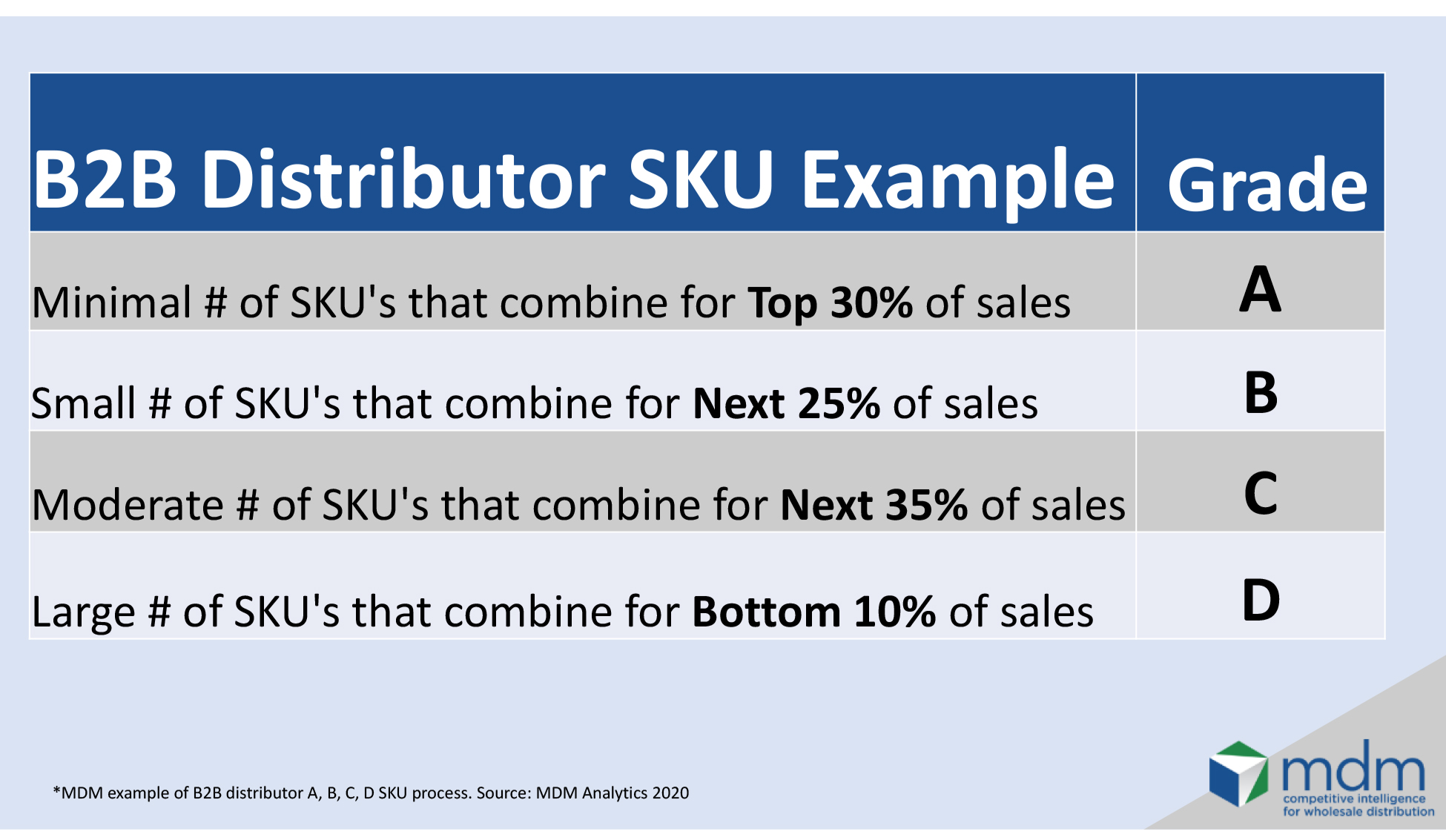

2.Build buffer inventory domestically for your imported product. The primary determining factor for choosing off-shore supply is low cost. The low cost “good” products allow you to competitively compete on these SKUs and win orders from the competition. In many cases you need that good product at that price, and often the only option is to source overseas. If you can’t move it, you may have to consider building buffer inventory to get you through the disruptions. We recommend you look at your SKU profile — A through D SKUs (see chart below) — and change your reorder points at the SKU level to get the proper mix of buffer inventory for your top-selling A and B SKUs.

3.Develop contingency plans such as near shoring (Mexico, etc.) or re-shoring (domestic supply). If you can build enough buffer inventory effectively while still maintaining a proper product carrying cost it will buy you time to look at other alternatives if your supply chain issues worsen.

4.If you are a multi-site warehouse distributor, optimize your inventory through warehouse transfers where possible and cost effective. There are times where the disruption is so great that you may not be able to build buffer inventory, or have time to build contingency supply plans. When you are in this situation and have multiple warehouses, move the SKUs where you need them.

Also see: “Win More Battles in Your Turbulent Distribution Marketplace.”

5.Utilize alternate channels and/or master wholesalers to bridge gaps during transition between offshoring and near-shoring/re-shoring. Master wholesalers fill a real need in the channel and when supply chain disruption is highest, they can be your best friend. Driving a customer to another distributor because you can’t get the product often puts you in a position where they don’t come back, or you have to price slash to get them back. Having a strong master wholesaler relationship can be a game changer for you.

6.Use your A, B, C, D inventory management system to prioritize products to act upon.

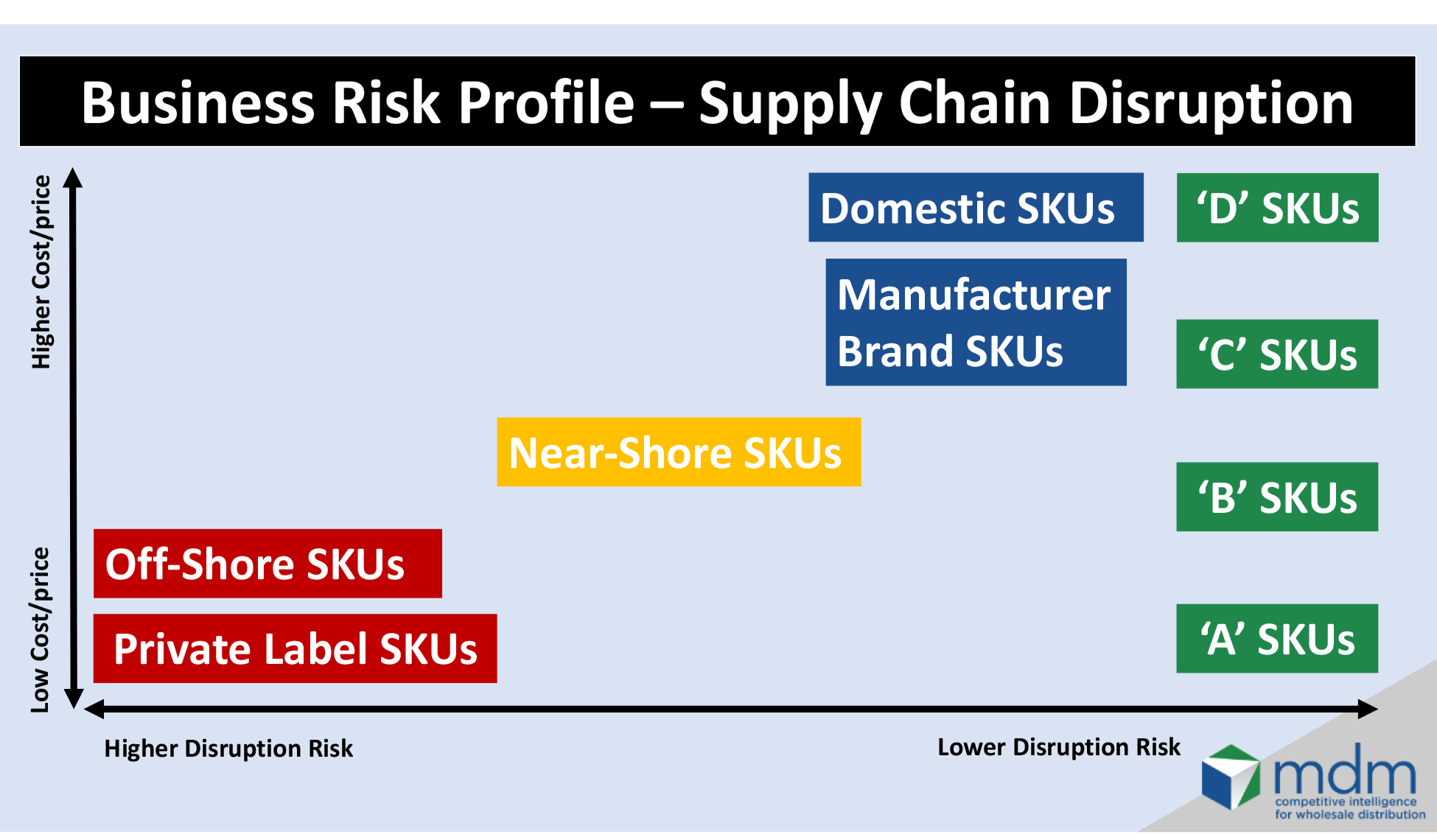

Your A and B SKUs are the most important to your customers and your business. Because they are the highest selling, they are often the most competitively priced to your end customer. That is why often many of your top-selling A’s & B’s may be sourced offshore or be private-label branded products. (see below chart*).

For example, an offshore, private label A SKU is your highest risk profile. It’s coming off a boat, it’s private label (where the manufacturer will deliver minimal support versus their branded line), and it’s an often lowest priced, but top-selling SKU for your business.

If you look at your risk profile at the SKU level and build proper risk assessment and contingency plans, it will help you to react quicker to supply disruptions.

Putting your competition on the defensive because you have the products where they can’t get reliable supply will help you take share in these troubled supply chain times.

As always, we would love to get your feedback. Please feel free to reach out to either of us at derek@mdm.com or john@mdm.com.

Hear Gunderson speak in person at MDM’s Sales GPS 2020 Summit in Chicago, May 11-13. Click here for the agenda and more information.

Derek Green is director of analytics at Modern Distribution Management. Prior to joining MDM in 2019, he had more than 25 years of supply chain experience in distribution and manufacturing, managing categories in excess of $500 million with companies such as HD Supply, Anixter, EIS, Rockwell International and the General Electric Company.

John Gunderson is VP analytics & e-business at Modern Distribution Management. Prior to joining MDM in 2018, he was a senior leader for 20 years leading category management, marketing, pricing, analytics and e-business with companies such as Crescent Electric Supply Company, HD Supply Power Solutions, HD Supply C&I White Cap, Anixter and EIS-INC, a Genuine Parts company.