The Analytics team at MDM recently held a live webinar exclusively for the Power Transmission Distributors Association (PTDA). The focus for the webinar was a topic that has received much attention from today’s leading distributors: What are the latest trends in my vertical, and how can I use them to benchmark and grow my business?

In a two-part presentation, they reviewed the leading and fastest-growing industries for power transmission products, followed by a few best practices distributors can employ to enhance their analytics efforts and grow their share of the market.

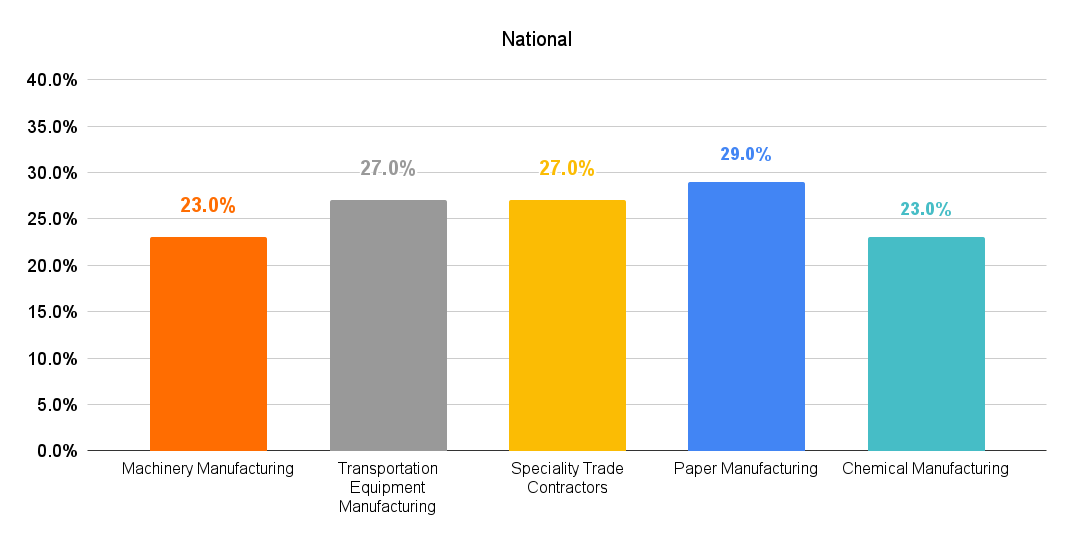

Machinery Manufacturing is the largest of the 5 categories however Paper Manufacturing is the fastest growing at 29%.

To leverage this information for benchmarking purposes, it’s important for distributors to have their internal data in order. Many leading distributors put a premium on high-quality, well-segmented data. Segmentation is a method of grouping data and turning large amounts of data into actionable information for better decision making and planning.

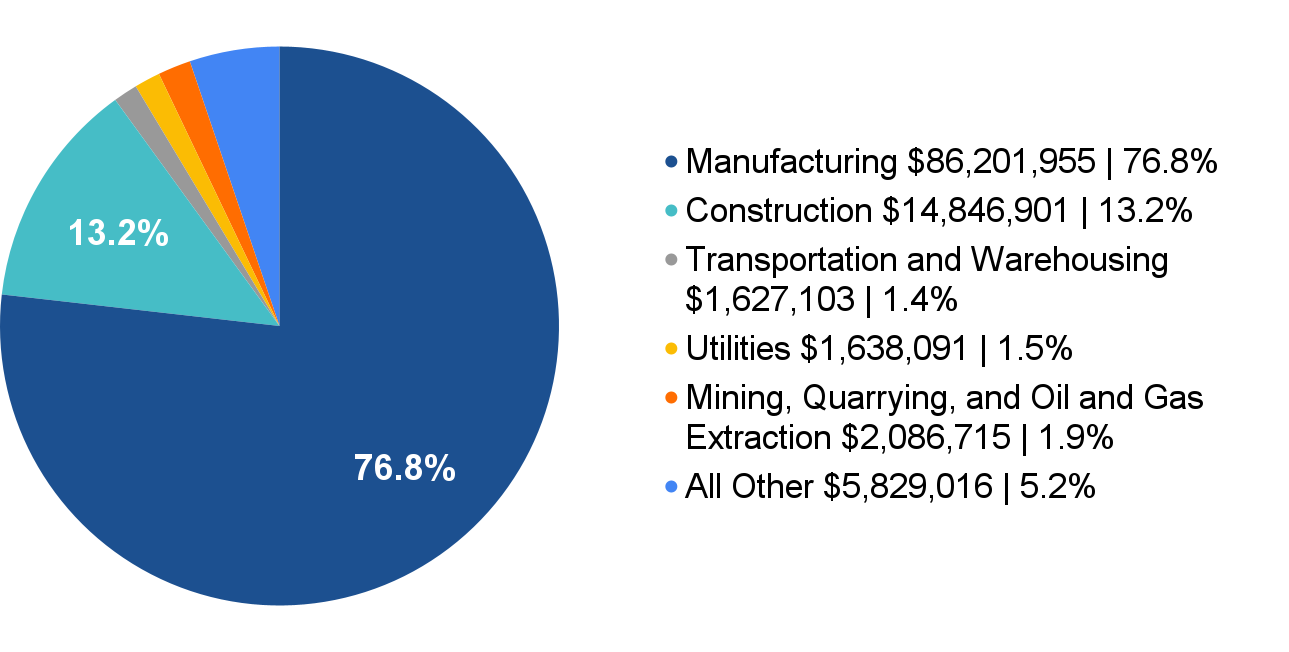

If you don’t know where to begin, our analytics team recommends starting with your customer records, where D&B’s firmographics data can be referenced to append DUNS numbers and industry classification codes (NAICS). This empowers you to segment your customer mix in the same format as trending market data in Figure 1.

Segmenting your internal customer records by the same industry classification standard as your external market data allows you to benchmark your customers’ sales patterns against the market trends. It is a powerful picture that provides actionable information to address goals and objectives.

Figure 2 is an example of a distributor’s customer mix segmented by NAICS 2 digit, where the manufacturing sector is the largest segment of business, accounting for nearly 77% of sales. This analysis is referred to as a sweet-spot analysis.

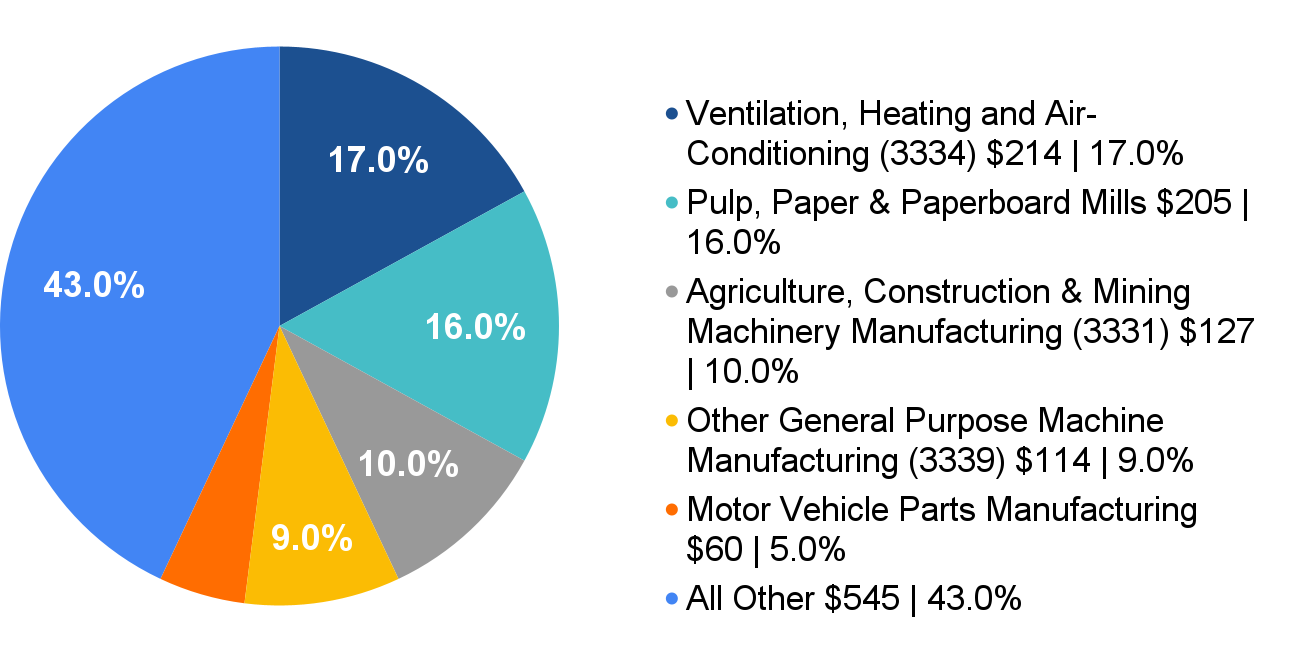

Now that we know the distributor’s customer mix, we can dive into the manufacturing market data. For example, as seen in Figure 3, you’ll notice the top five segments represent 57% of Georgia’s demand for Power Transmission products with Ventilation, Heating, Air-Conditioning, and Commercial Refrigeration Equipment Manufacturing (NAICS 4: 3334) sector leading the pack with 17% of total demand.

Combining you customer sweet-spot analysis with market data is a quick way to realize your strengths and weaknesses in your respective markets. Also, this expanded view of your business can be used to find new customers by taking your analysis to the street level and focusing on your strongest segments.

For over 20 years, MDM has been a trusted partner, providing distributors with data and market expertise to grow market share. If you have any questions or would like to learn more about how you can take your data analytics to the next level, reach out to the MDM Analytics team at analytics@mdm.com.

Related Posts

-

In this week's MDM podcast, ProfitOptics CEO Tony Pericle shares his passion for how distributors…

-

Drive revenue this year with these four ways to strengthen sales analytics that cut through…

-

Like a New Year’s hangover, pricing and inflation shape 2022 challenges, says the latest Baird-MDM…