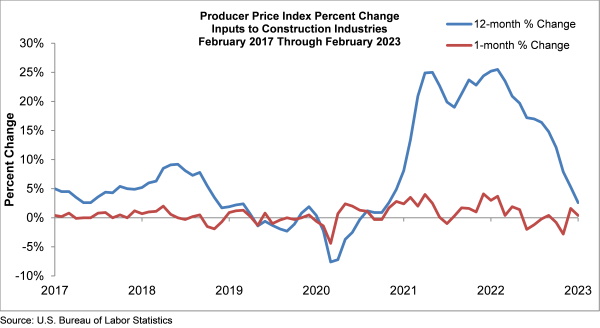

Construction input prices expanded 0.4% between January and February, according to an Associated Builders and Contractors (ABC) analysis of U.S. Bureau of Labor Statistics Producer Price Index data released March 15.

Nonresidential construction input prices also rose 0.4% in February, according to ABC. Construction input prices overall are 2.6% higher than a year ago, while nonresidential construction input prices are 2.8% higher. Natural gas prices plummeted in February, down 41.4%, while crude petroleum prices rose 7.3%. Unprocessed energy materials prices were down 9.1% in February, ABC said.

“While the February construction materials price inflation data appear benign, a peek behind the headline numbers indicates that price pressures remain abundant,” ABC Chief Economist Anirban Basu said in a news release. “As an example, the price of brick and structural clay tile expanded 3.4% for the month and is up nearly 9% over the past year. The price of copper wire and cable increased 3.3% on a monthly basis and is up 40% since February 2020. In large measure, sharp declines in energy prices have pushed headline numbers lower in recent months, but there is plentiful evidence of lingering materials price inflation and supply chain challenges in the data.

“With growing pressure on the global banking system and the Federal Reserve still wrestling with excess inflation, risks of recession continue to expand. While contractors performing public construction and working on industrial megaprojects stand to fare well during the years ahead, the fortunes of many other contractors are increasingly threatened by elevated costs of capital, tightening financial conditions and the rising cost of delivering construction services. Eventually, these factors could whittle away at backlog, which is currently elevated, according to ABC’s Construction Backlog Indicator, creating greater challenges for contractors in 2024 and/or 2025.”

Related Posts

-

Construction input prices fell 0.9% in November but remain 40% ahead of February 2020 pre-pandemic…

-

Construction input prices dipped 0.1% in September compared to the previous month but remained 41%…

-

Overall, construction input prices are 7.9% higher than a year ago, while nonresidential construction input…