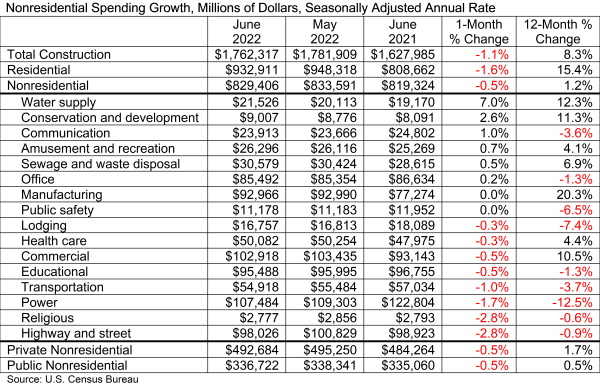

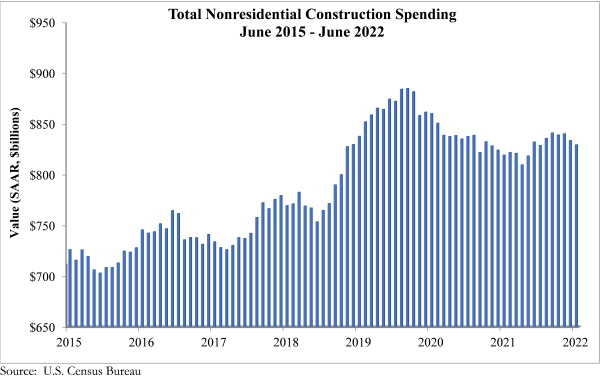

Data released Aug. 1 by the U.S. Census Bureau shows that national nonresidential construction spending slid 0.5% in June compared to May to a total of $829 million. Year-over-year, that total was up 1.2%

Data analysis by Associated Builders and Contractors found that spending was down month-to-month in eight of the 16 nonres subcategories, while both private and public nonres spending fell by 0.5%.

“There continues to be significant downward pressure on nonresidential construction spending volumes, and that is likely to intensify going forward,” ABC Chief Economist Anirban Basu said. “To date, construction spending measured in dollars has been propped up by elevated construction delivery costs, including higher materials prices and rapidly rising wages. Despite those inflationary pressures, aggregate nonresidential construction spending has failed to recover to pre-pandemic levels in nominal terms. The situation looks even worse when adjusting for inflation.”

Residential construction spending had an even larger month-to-month decline, down 1.6% in June to a total of $933 million, though it was up 15.4% year-over-year.

Total June construction spending of $1.76 billion slid 1.1% from May and was up 8.3% year-over-year.

“The primary issue is that those high construction delivery charges are inducing a significant fraction of project owners to reconsider start dates,” Basu added about nonres construction. “True, backlog remains elevated, according to ABC’s Construction Backlog Indicator, but this may be because it is taking longer to complete projects. Additional project delays and cancellations are likely as borrowing costs continue to ratchet higher for those who purchase construction services and as the risk of recession increases. For now, many contractors remain busy and continue to operate at or near capacity. Whether that will continue for another 12 to 18 months remains an unanswered question.”

Related Posts

-

The commercial construction supply distributor announced the asset purchase of Service Construction Supply and its…

-

The facility will house a wall-coatings tint line to provide custom-color material and an accessories…

-

Construction prices rose 2.3% in May compared to the previous month, and construction input prices…