MDM is providing this Premium content for free so that everyone can access important information about the ongoing impact of the coronavirus on distribution. For access to more content like this in 2021, sign up for MDM Premium.

MDM’s quarterly survey in partnership with investment banking firm Baird reveals a consensus among more than 600 participants: The industry began feeling the effects of the pandemic shutdown very quickly in March, with many expecting to experience an impact on business operations, supply chain, cash flow and even solvency through at least the end of the year.

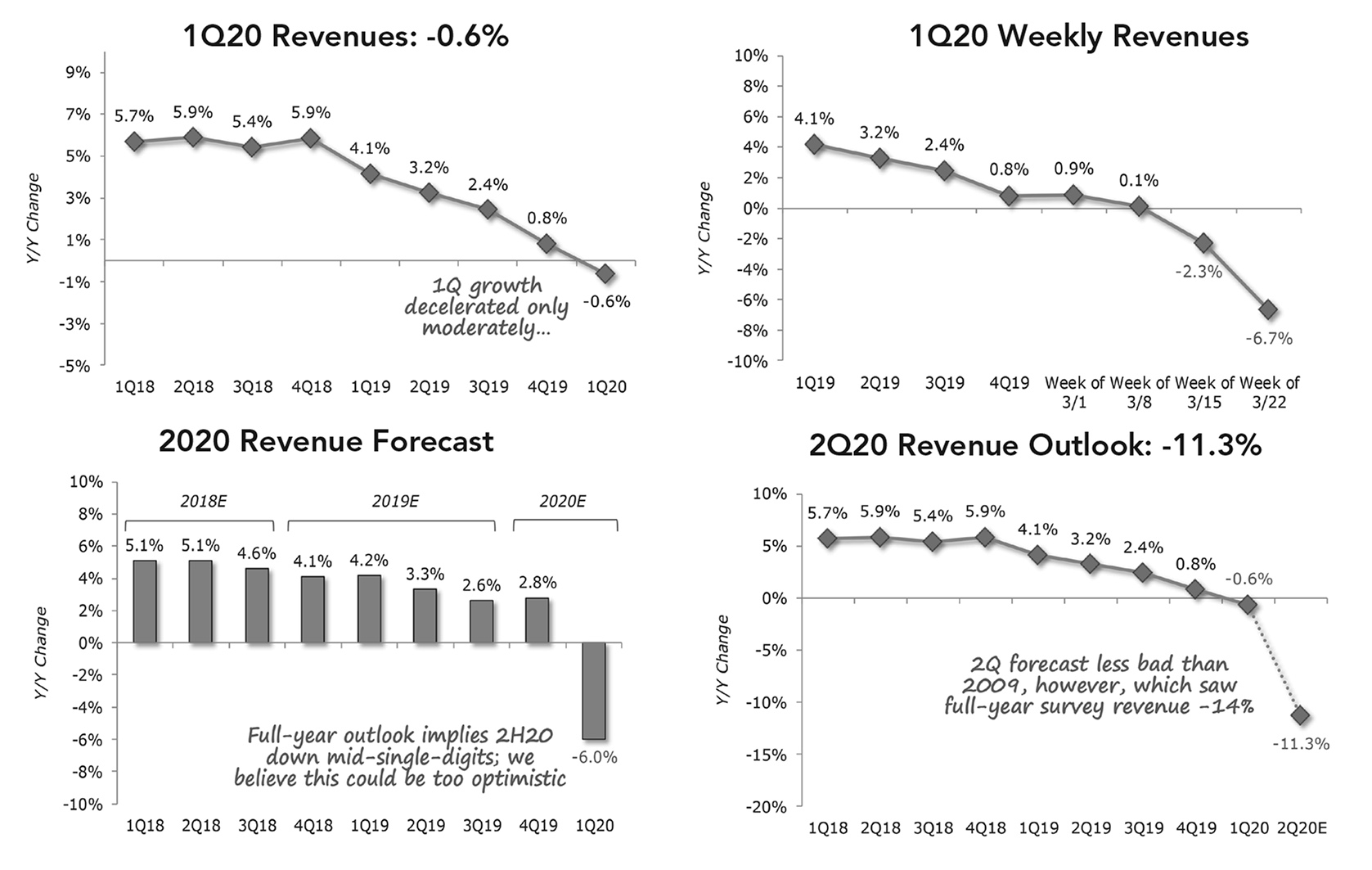

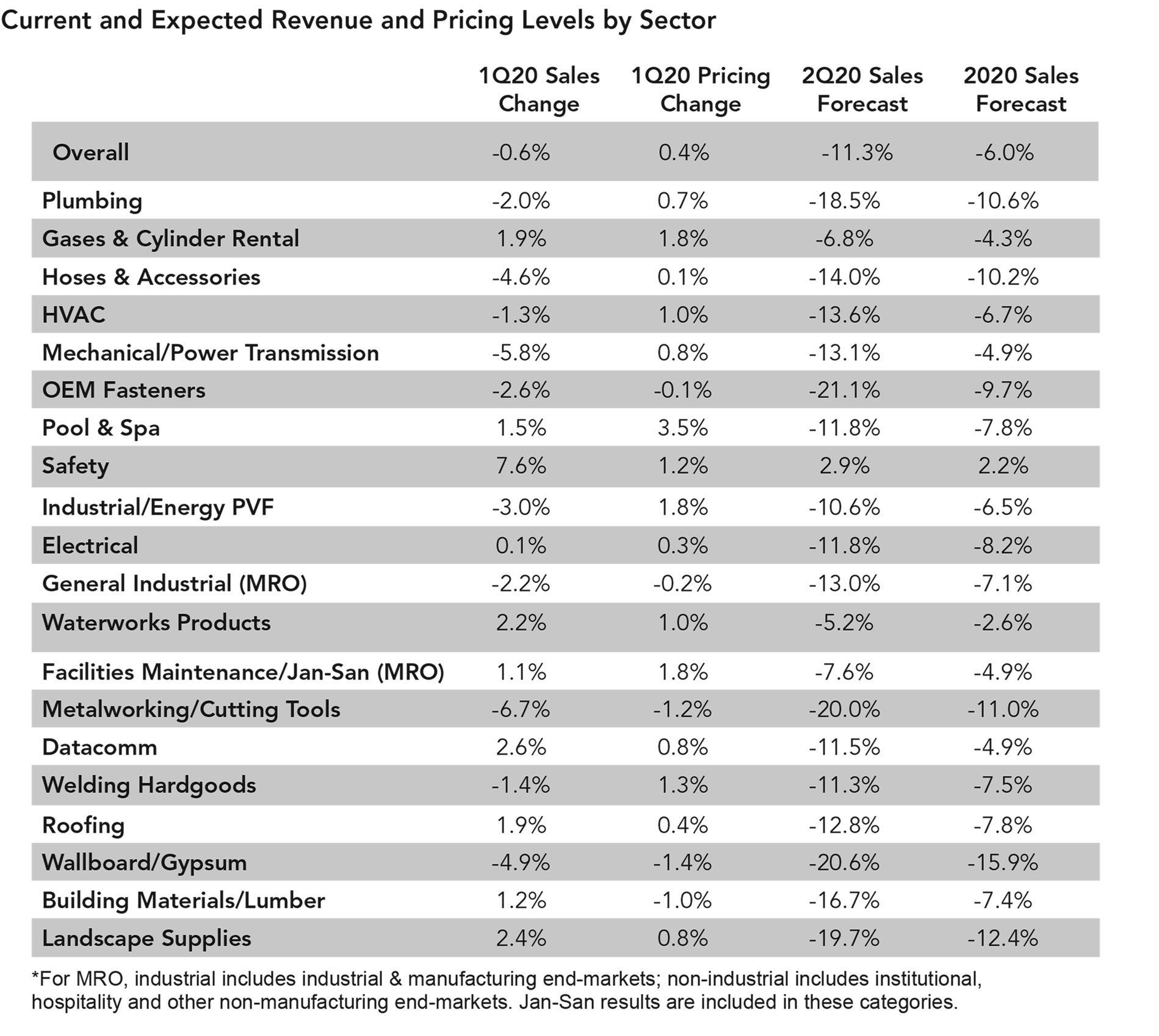

With the long-term economic outlook clouded by the coronavirus, distributors and manufacturers are taking a matter-of-fact approach to the second quarter and beyond, bracing for the fallout of a disruption to business that came abruptly. While first quarter financial results were relatively good for most distributors — plus or minus a few percentage points and consistent with the end of 2019 — of the 18 product categories surveyed in the quarterly MDM-Baird Distribution Survey, nearly all of them are projecting downturns for the second quarter. Only safety products have a growth outlook (2.9%), with waterworks (-5.2%), gases and cylinder rental (-6.8%) and Jan-San (-7.6%) expected to be in single-digit decline. The others are looking at an average of -11.3%, with some expecting up 20% or greater decline.

“Every single company that we cover is going to step in a hole in the second quarter,” says David Manthey, senior research analyst covering industrial distribution and commercial services and supplies at investment banking firm Baird. “The question is, how deep is the hole, how do they get out of it and can they make it to the other side?”

To gain an idea of how precipitous the decline was in March, Baird asked the 620 respondents — with aggregate revenues north of $100 billion — for a weekly breakdown of their year-to-year change in sales. The progression went: March 1, +1; March 8, flat; March 16, -2; March 27, -7. With the market “clearly in a recession now,” Manthey predicted it will likely be the first half of 2021 before things start to recover.

When asked to share the actions they are taking in response to COVID-19, the vast majority of respondents report they are asking employees to work remotely (87%). Nearly half (47%) are reducing future inventory orders and one-third (33%) are laying off employees.

The relatively sudden and all-encompassing impact of COVID-19 necessitates a different approach to this quarter’s MDM-Baird Distribution survey results. Rather than an individualized sector outlook, we outline the central themes that emerged from distributor and manufacturer responses to the survey.

1) Interruptions and Closures are Broad-Based

While only 11% report temporarily closing their own branches as of now, many are experiencing closures at the customer level. Manthey describes the last Friday in March as a tipping point for businesses shuttering and plants closing. “We’re just at the beginning of things rolling over right now,” he says. “It is certainly happening and it’s happening in a big way.”

Mindsets are starting to shift from expecting weeks-long closures to bracing for potentially a couple of years dealing with some degree of COVID-19 closures. One respondent predicted, “This will take two years to fully recover to previous levels.”

Other key responses indicating the wide-range of business disruptions include:

- “We see service/repair being the foundation for 2020 as capital projects are being stalled or cancelled.”

- “Some manufacturing customers were already slow before COVID-19, now several are shut down.”

- “While a plan for some softening in the residential new market was expected to begin closer to election time, the virus has stopped all new planning.”

- “Lower amount of bids/jobs coming through now will slow sales down the road.”

- “Existing jobs will continue but I’m concerned that jobs on the books that are not quite yet out of the ground will get put on hold.”

2) Lead Times are Surging Amid Wide-Reaching Supply Chain Disruptions

Manthey notes that private investor outlook on the distribution sector spans the range from those in a ‘V’ shaped quick-recovery camp to others who are bracing for a long-term disaster. Either way, he says, “the second quarter, it’s going to be bad.”

The wild swings seen in the stock market, with the Dow moving as much as a thousand points a day, are a signal that there is no real lasting consensus. But Manthey expects numbers will continue to be down into the third quarter. There may be a lift in some sectors, such as non-residential construction where projects have been in the works for years, but don’t expect a quick fix. Long lead times and wide-ranging supply chain difficulties will be a factor in recovery timing. Even for some distributors reporting “extremely high demand,” the supply is not there to meet it.

Respondents describe the supply and demand issues they are facing:

- “We are seeing suppliers shut down or increase lead times.”

- “Demand is extremely high. Supply chain is tightening, with government allocations doubling costs.”

- “Job activity was up in 1Q20 vs. 1Q19; however, we’ve lost sales due to a shortage of available product from vendors. We had the PO in hand, but contractors couldn’t wait until April, May and June for product so got product elsewhere.”

- “As COVID-19 started hitting our markets, demand jumped up as customers tried to stock up in anticipation that supply may be shut down. Their primary concern so far has been availability of materials, not a slowdown of business.”

- “Right now, this virus has turned our market upside down. If you are open and have any inventory, people are buying it.”

- “We are getting notices of vendor closings and deferrals, plant closings and layoff. Price increases from vendors and freight increases all on lower volume of sales.”

- “Things were already in decline prior to the outbreak, but the last half of March was grim. We could balance things better with PPE sales, but finding inventory is mostly impossible.”

3) Competitive Pressures Expected to Rise Dramatically

In previous market downturns, industrial distribution and MRO companies in particular have shown some countercyclical activity as far as stock market performance. Of course, past performance does not guarantee future results, but Manthey notes that in the last three recessions these stocks tended to bottom either ahead or in the middle of the recession — and then outperform for several years coming out of it. But first, they need to stay in business. “There’s a lot of complexity out there and it’s our view that we’ll see this continue for a while and it’s not going to be a quick recovery,” Manthey says.

Survey respondents are feeling the pressure:

- “Prices are going to get dragged down as distributors fight for business to recoup early-year losses.”

- “I think that pricing will tank because what work gets down, it will be a dogfight in the market to get it on price.”

- “Margin is down slightly but the fear is consumers will stop spending; trying to save cash in a few weeks is a major concern.”

- “Gross margin is taking a hit due to pricing pressures from competition trying to keep money flowing through.”

- “High pressure on lower pricing to customers. Many customers asking for extended terms during these times.”

- “Pricing will face strong headwinds as value propositions for face-to-face service become rare. Distributors optimized for cost to serve will do better than distributors that don’t understand SKU profitability. We see tremendous opportunity to take costs out of inefficient quoting and purchasing.”

- “Unfortunately, desperate times have created desperate selling/customer acquisition tactics.”

4) Cash-Flow Concerns are on the Rise — Especially Accounts Receivable

At the end of March, W.W. Grainger drew attention when the company drew down $1 billion from its revolving credit. A lot of companies are positioning themselves to act very quickly to be in the right place during this pandemic slowdown, Manthey says. “We’ve seen that a number of companies are pulling down their lines,” he says. “… I think it brings to light the issue here, which is, balance sheet first. Make sure you’re in a good position to survive because how deep this hole is in the second quarter, I don’t know that it really matters — what matters is you survive to the second quarter of 2021. “That’s what you’re seeing companies do. Just prepare and plan for the worst and hope for the best.”

In a normal down market, management tactics might start with addressing costs, but this time around, Manthey expects more companies to start with the balance sheet. “When I think about the stocks that have performed the best during this downturn, it’s been those with clean balance sheets. First and foremost, it’s the No. 1 factor that’s driven results in the near term,” he says.

This can be an issue in distribution, where you’re selling a range of products to many small customers. “If those small businesses run into trouble and they can’t pay, whether that’s bankruptcy or just stretching it out or what have you, there could be some financial stress to the cashflow statement,” Manthey adds. “Whether it’s a large public company or a medium or small distributor.”

Many survey respondents addressed cash-flow issues already taking place:

- “Customers are expecting/needing extended terms, so we will see some profit declines in short term.”

- “Cash flow has moved up in priority. This will lower margin expectations.”

- “1Q was fairly steady until mid-March, then we started to receive order pushbacks (deliveries delayed) and delayed payments from customers.”

- “Customers are dealing with zero cashflow and we are being asked to pay for receivables.”

- “Issues are going to be customers that are requesting or just taking extended terms, so collections and cash flow will be a problem throughout 2020.”

- “It’s going to be hand to mouth for the next two to three quarters. Cash management is a top priority.”

- “Cash flow will be stretch, as some customers are already unable to pay invoices.”

- “We all need to hope that customers keep paying their bills or everyone is screwed.”

5) Significant Share Shift Possible Amid Profitability, Solvency Concerns

Respondents expect there will be some companies that do not survive the COVID-19 downturn — “Customers, suppliers and competitors will be impacted, putting strain on cash and ultimately putting some out of business,” said one. While some businesses were weakened to begin with, others will be slow to react or adjust their value propositions before it’s too late, respondents predict.

Some are resigned to the big getting bigger:

- “This looks like a great time for box stores to finally kill off the independents.”

- “We are seeing a revenue shift to bigger distributors and e-commerce markets like Amazon.”

- “Some smaller competitors will certainly go out of business will be interesting how aggressive larger competitors are with job cuts.”

Others are bracing for expected losses:

- “Revenue is in the toilet. Working to recover and get back running. Not expecting a profit this year.”

- “We now have stress-tested losing 30% to 60% of revenue.”

- Yet some respondents see an opportunity in the crisis and are pivoting their businesses accordingly:

- “Massive investment in all things eCommerce: website, product information management, SKU profitability analytics, order bundling, paid search.”

- “Increase in online presence and decrease in counter sales/foot traffic.”

- “Expect significant short-term impacts, with an opportunity to take share in the long run.”

Related Posts

-

Please join us for our live program this Friday, Mar. 27, 2-4 pm Eastern, where…

-

Last weeks Pulse indicated that more than half of distributors indicated sales were down more…

-

Distributors posted aggregate revenue growth (excluding acquisitions) of 0.8% during the fourth quarter of 2019…