process. Different software companies have embraced the approach to different degrees.

You will be reading and hearing a lot more about the concept over the next couple of years. And, as always, there will be some confusion before the smoke clears. Gordon Graham didn't change distribution in a day, and it will take some time for strategic pricing to become fully fleshed out.

However, now is the time to take a good hard look at how you are really doing your day-to-day pricing. You probably won't like what you see, and that will give you a good reason to learn more about what today's technology can do for you.

Tim Reynolds is the president of Tribute Inc., a distribution management software company focused on industrial distributors in hose, hydraulics, pneumatics, rubber products and related industries. He may be reached at 330-656-3006 or treynolds@tribute.com.

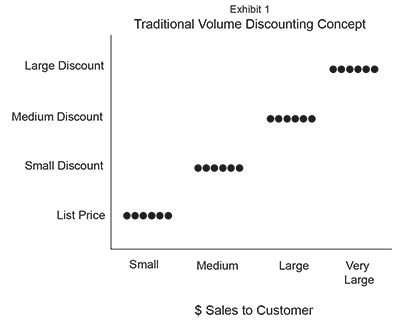

intention is that small customers who only call occasionally and buy very little from the distributor should get a smaller discount or pay list price. The best customers should, of course, get the best price.

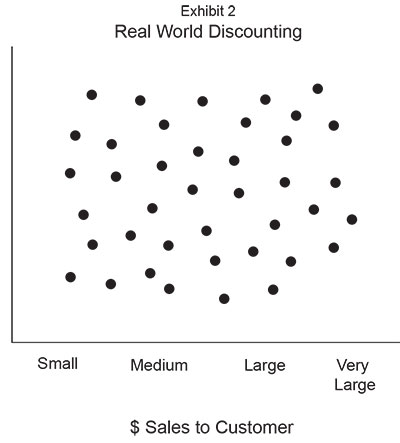

But, without regular analysis and active management, pricing ends up over time actually looking as it does in Exhibit Two.

In other words, there is very little relationship between the importance of the customer to the business and the pricing that the customer receives. Instead, pricing is dependent on which salesman did the deal, or whether the customer bought lunch that day, or whether it was the end of the month. Whatever set the price, it wasn't a coherent and well implemented strategy designed to grow a profitable business.

The objective of strategic pricing is to create results like Exhibit One for every item in your inventory with appropriate discounts for each of your customers. Even for your largest customer, you probably want to give better discounts for his most frequently purchased items than for items he only buys occasionally.

So potentially every item needs to be considered for every customer. Now, an average distributor might have 3,000 customers in his system and be able to sell perhaps 20,000 items. That's a lot of possible pricing points! (60,000,000 to be exact.) Even the most diligent sales manager would be unable to develop that strategy, let alone manage it over time.

As you can see, we are at the same point that your grandfather was at if he wanted to accurately forecast demand and set appropriate order points and line points for each item in his inventory. It's impossible to do without a computer.

But if you could do it, imagine the impact on your bottom line. Tribute has customers who feel that, when implemented properly, strategic pricing will add 3 to 4 percent to their margins.

O.K., exciting concept, but what does it take to make it happen? Well, the first thing is using the power of computers to analyze your current pricing behavior. You need to be able to develop something similar to Exhibit Two to see where your company is at right now.

Then, you need to set the parameters for how you will price in the future. You have to segment your customer base and determine how you will price items for each customer segment.

Going deeper, you will want to evaluate each major customer and determine how you want to spread discounts across all the items he buys. You have to model the proposed price changes and determine what the bottom line impact will be and then fine-tune your strategy. Almost certainly, you will need outside help to get this done. It is a massive job and requires very sophisticated data analysis software.

The consultant who helps you should also be able to help you develop procedures to manage your pricing over time. It is important to stress that this is an ongoing process. You can't just do it once and expect your strategy to stay in place forever.

Customer buying habits change. Competitors react to your moves and new products emerge. Salesmen override your prices without appropriate justification. Stuff happens. You will need to do this analysis at least annually and you will need a variety of management information tools to maintain the level of control required. It is a big change in how you do business. But, is 3 to 4 percent to the bottom line worth the change?

Finally, your enterprise software must be able to provide the data necessary to do the analysis and then provide the tools required to incorporate your new pricing strategy into the order entry programs and manage pricing going forward. This is no simple task either.

As I said, though, it is still early days for this "next big thing." Different consultants are taking different approaches to the analysis and implementation of this new

About 26 years ago, a gentleman from Dallas, TX, named Gordon Graham revolutionized distribution with his book "Distribution Inventory Management." In the book, he taught distributors how to use computers to manage their inventory. More than anyone else, Graham brought distribution asset management from a manual "kardex" based system to the modern age.

To quote from his later update to the original book: "The computer's magnificent capabilities allow new ways to capture and use information, remove the grunt' work from dreaded activity of years' past, and permit new levels of profits. No longer does a distributor have to make a 30 percent gross margin (as in the 50s and 60s) to survive."

Fundamental to Graham's work was an old mathematical concept called "Economic Order Quantity" (EOQ). It is a formula that allows a purchaser to determine the appropriate order quantity and frequency based on a forecast of demand. Using the formula allowed a purchaser to optimize the level of inventory and minimize his investment in this asset.

But applying EOQ to the tens of thousands of parts in a distributor's inventory was so laborious as to be impossible before computers. Until mid-range business systems with names like "Qantel" and "MAI Basic Four" came along and until Mr. Graham taught us how to use them, distributors relied on experience and "SWAG" to manage their inventory.

Graham showed us how computers could manage the massive amount of data in a distribution business and develop a purchasing plan that would result in lower inventories, higher turnover and bigger profits. In short, Gordon Graham ushered in the first wave of modernization in the supply chain since the advent of the industrial revolution.

Strategic Pricing

What is the next wave of fundamental change in distribution? I am not talking about gadgets and tweaks. RFID or even CRM, for example, aren't fundamental changes in how distribution is managed. They represent incremental improvements to current processes.

What is on the horizon that will fundamentally change how distributors make money? Graham helped distributors make fundamental changes on the buy side. I would like to suggest that we are in store for some fundamental changes on the sell side. Specifically, technology now is ripe to allow distributors to manage pricing in ways that were unimaginable even 5 years ago.

While it is still early for this "next big thing," increasingly we at Tribute Software are working with consultants and customers who are focusing on managing pricing in a very different way. Depending on which consultant you talk to, this process is called "Managed Pricing" or "Effective Pricing" or "Strategic Pricing." No doubt there are other names for the concept as well. No one consultant has grabbed the brass ring of pricing guru (yet) that Mr. Graham captured for inventory management.

To understand the strategic pricing process, let's first look at how things are usually done today. Most distributors today manage pricing decisions the way their fathers or grandfathers managed inventory: by experience and SWAG.

Generally, discounting guidelines are set by management, but day-to-day pricing decisions are in the hands of the sales force. It is not unusual for different sales people in the same company to quote different prices on an item, even to the same customer.

Management reporting and controls on pricing, while widely available in all serious distribution software programs, are often not rigorously applied. Over time, whatever pricing strategy management had in mind devolves into an almost random mess.

Management may intend for the pricing for a given item or product group to behave as shown in Exhibit One.

In other words, the more he buys of a given item, the greater the discount the customer gets. The