U.S. wholesale prices continued their disinflation run in November, with the Labor Department’s latest Producer Price Index showing that key indexes that measure inflation before it reaches consumers trended closer toward breakeven.

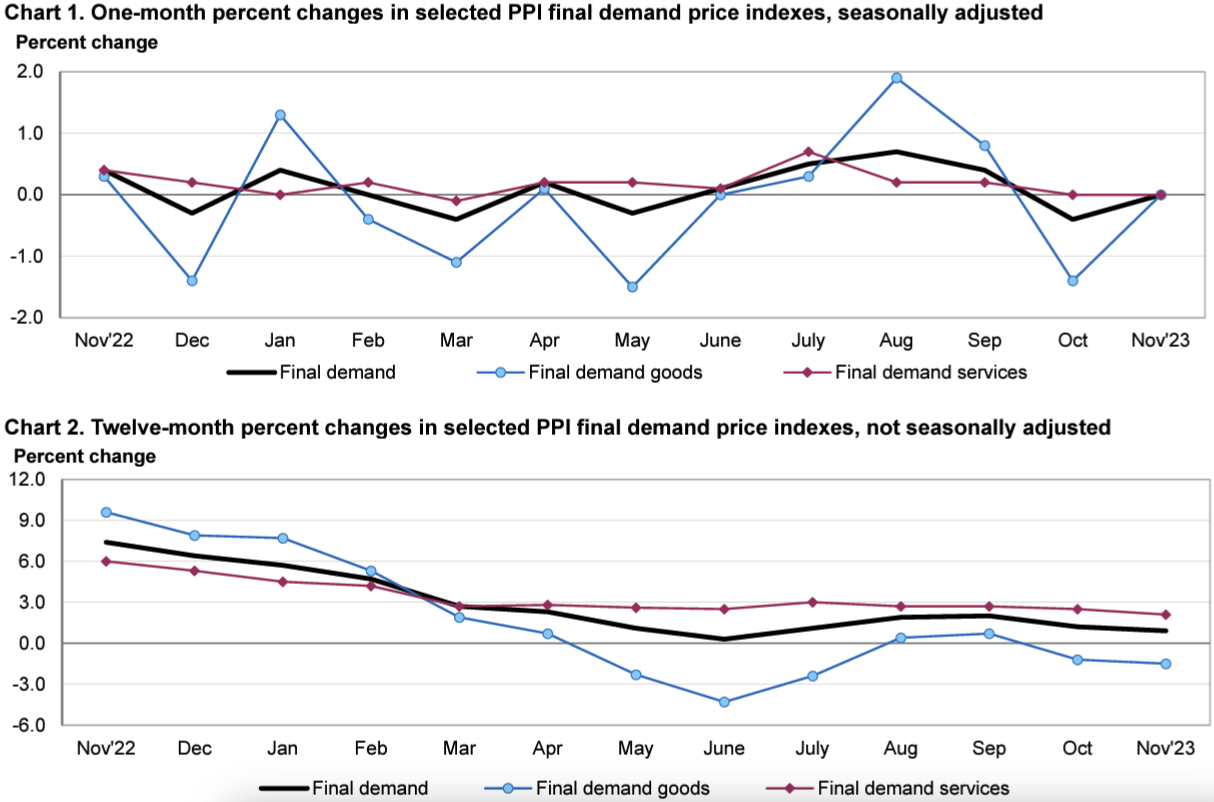

Released Dec. 13, the department’s Bureau of Labor Statistics November Producer Prices Indexes report showed that the index for final demand was unchanged in November month-to-month, after increasing 0.4% in both October and September.

Meanwhile, November’s final demand index increased 0.9% year-over-year, a continued deceleration from October’s 1.2%, September’s 2.0% and August’s 1.9%.

For context, November 2022’s final demand index was up 7.4% year-over-year.

CPI: November Consumer Inflation Slowed to 3.1% Annual Gain (Dec. 12)

In November 2023, the indexes for both final demand goods and final demand services were unchanged from October.

Core PPI — which removes foods, energy and trade services — edged up 0.1% in November month-to-month for its sixth consecutive increase. That follows advances of 0.1% in October, 0.3% in September and 0.2% in August. Year-over-year, core PPI rose 2.5% in November, decelerating from 2.8% in October, 2.9% in September and 2.9% in August.

For much more monthly wholesale information, check out Executive Editor Mike Hockett’s Dec. 11 Premium article recapping the U.S. Census Bureau’s latest wholesale trade report data.

Related Posts

-

Economists polled by the Wall Street Journal had predicted a 0.2% increase in the producer…

-

July's PPI increased at a faster pace in July vs. June, with core CPI posting…

-

Core inflation edged up 0.3% month-to-month and ended November up 4% from a year earlier.