Robot sales in North America took a considerable downshift in 2023 after a record 2022 and 2021, according to the latest report from the Association for Advancing Automation (A3).

The firm shared that North American companies purchased 31,159 robots in 2023, compared to 44,196 ordered in 2022 and 39,708 in 2021.

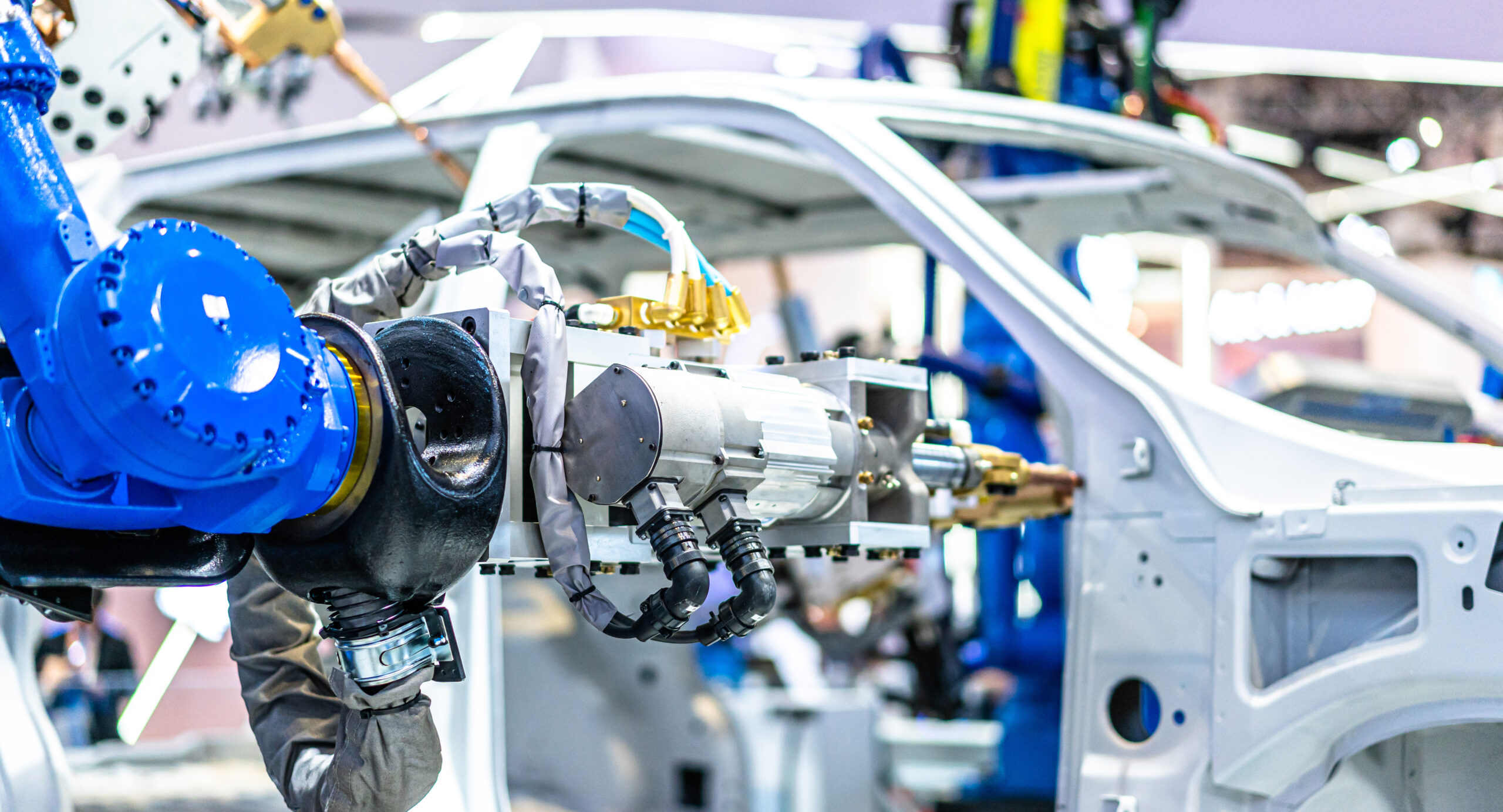

The 2023 orders were divided almost equally among automotive (15,723 robots sold) and non-automotive companies (15,536) — a 34% drop in ales to automotive OEMs and automotive suppliers vs. 2022 and a 25% total decrease in all other industries.

“While robot sales naturally ebb and flow, the return to more typical robot sales after the last two record years can likely be attributed to a few obvious issues: a slow U.S. economy, higher interest rates and even the over-purchasing of robots in 2022 from supply chain concerns,” A3 President Jeff Burnstein said in a Feb. 12 news release. “We’ve seen a slowdown in the manufacturing of electronic vehicles this year along with fewer new distribution centers, both likely reducing the demand for robots. From what we’re hearing in our member surveys and at recent events, however, optimism is strong for growth, potentially picking up in the second half of the year. In fact, we anticipate record numbers at our Automate Show in May as more companies prepare for new automation projects.”

A3’s data found that in 2023, the strongest demand for robots from non-automotive companies came from the metal industry, followed by semiconductor & electronics/photonics; food & consumer goods; life sciences, pharmaceutical and biomedical, plastics & rubber, and others.

While each of those industries showed an overall 2023 orders decline, A3 noted that the year’s fourth quarter saw higher sales in automotive (both OEM & components), metals, semiconductor & electronics/photonics, plastics & rubbers, metals and the All Other Industries category, leading to a sequential increase of 20% vs. 3Q23. The All Other Industries category includes companies in areas such as construction, hospitality and agriculture, typically newer to robotics.

“While robotic sales were down over the year, 2023 ended with both an increase over the previous quarter and a nearly equal number of sales from automotive and non-automotive companies,” Burnstein added. “Both are promising signs that more industries are becoming increasingly comfortable with automation overall. While we expect to see automotive orders rise again, there’s little doubt that orders will increase from all non-automotive industries as they recognize how robots can help them overcome their unique challenges.”

Related Posts

-

Take a look back on the year and see what news stories drew the most…

-

AD owner/members total sales increased 5% in 2023 vs. 2022.

-

PTDA named Chris Bursack as the 32nd recipient of its Warren Pike Award for lifetime…