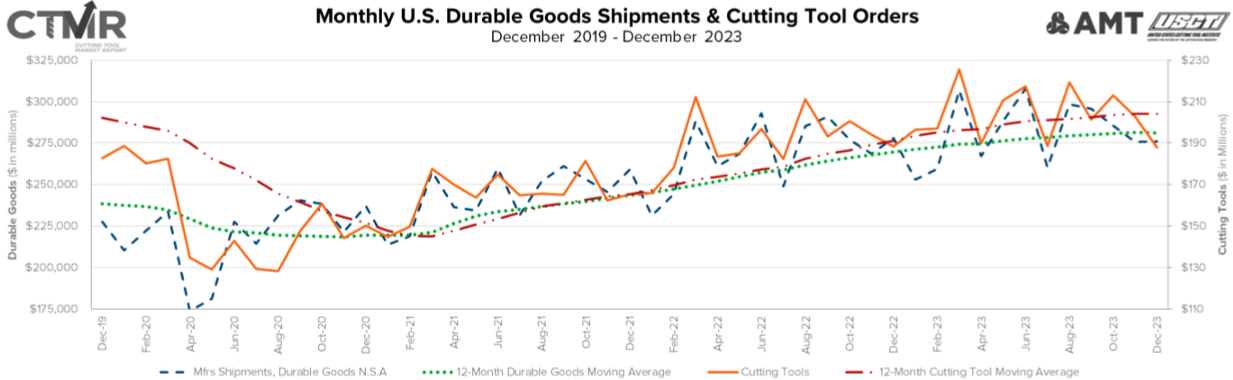

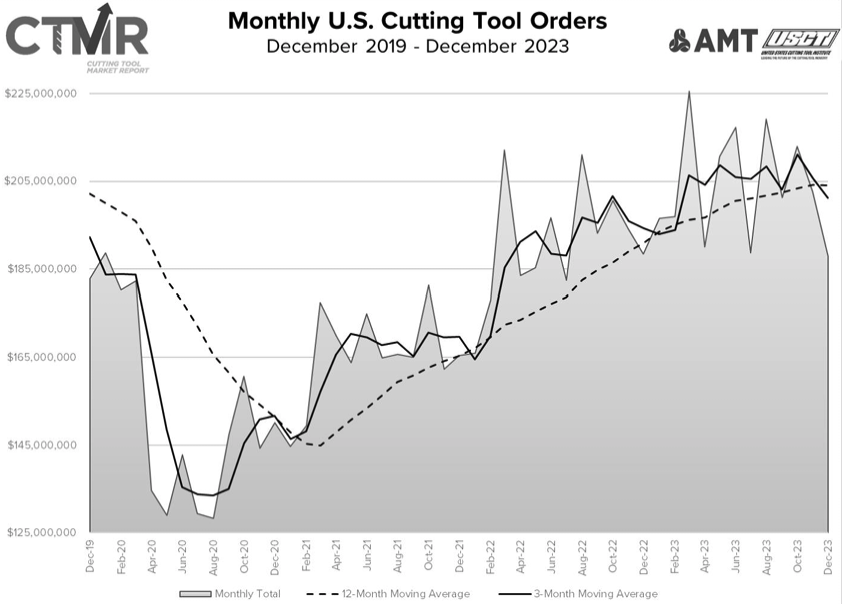

December 2023 U.S. cutting tool consumption totaled $187.9 million, according to the latest Cutting Tool Market Report (CTMR) published by the U.S. Cutting Tool Institute (USCTI) and the Association for Manufacturing Technology (AMT).

That total was down 7.3% from November and down 0.3% year-over-year. However, it brought 2023’s year-to-date total to $2.45 billion, which was up 6.9% vs. 2022.

These numbers and all data in this report are based on the totals reported by the companies participating in the CTMR program. The totals here represent the majority of the U.S. market for cutting tools.

“With 2024 comes change and challenge,” USCTI President Steve Boyer stated in the monthly report. “The U.S. cutting tool industry will continue to see growth opportunities in aerospace, automotive, medical and computer-related segments but slowing and declines in other markets. While forecasts initially anticipated interest rate declines as we moved into 2024, recent inflation indicators appear to temper those expectations. We enter the new year with a guarded view anticipating continued challenges and uneven growth.”

The CTMR is jointly compiled by AMT and USCTI, two trade associations representing the development, production and distribution of cutting tool technology and products. It provides a monthly statement on U.S. manufacturers’ consumption of what they tout as the primary consumable in the manufacturing process — the cutting tool.

“After a strong start to 2023, shipments of cutting tools weakened in the last quarter of the year, falling 7.3% in December,” added Mark Killion, Director of U.S. Industries at Oxford Economics. “As a result, shipments ended the year near their 2022 levels.”

The graph below includes the 12-month moving average for the durable goods shipments and cutting tool orders. These values are calculated by taking the average of the most recent 12 months and plotting them over time.

Related Posts

-

It gains WALTER a South Carolina based manufacturer that has roots dating back to 1874.

-

Consumption slide month-to-month, while year-to-date orders outpaced 2022’s first nine months by 8.1%.

-

U.S. cutting tool consumption totaled $219.2M, according to the U.S. Cutting Tool Institute and Association…