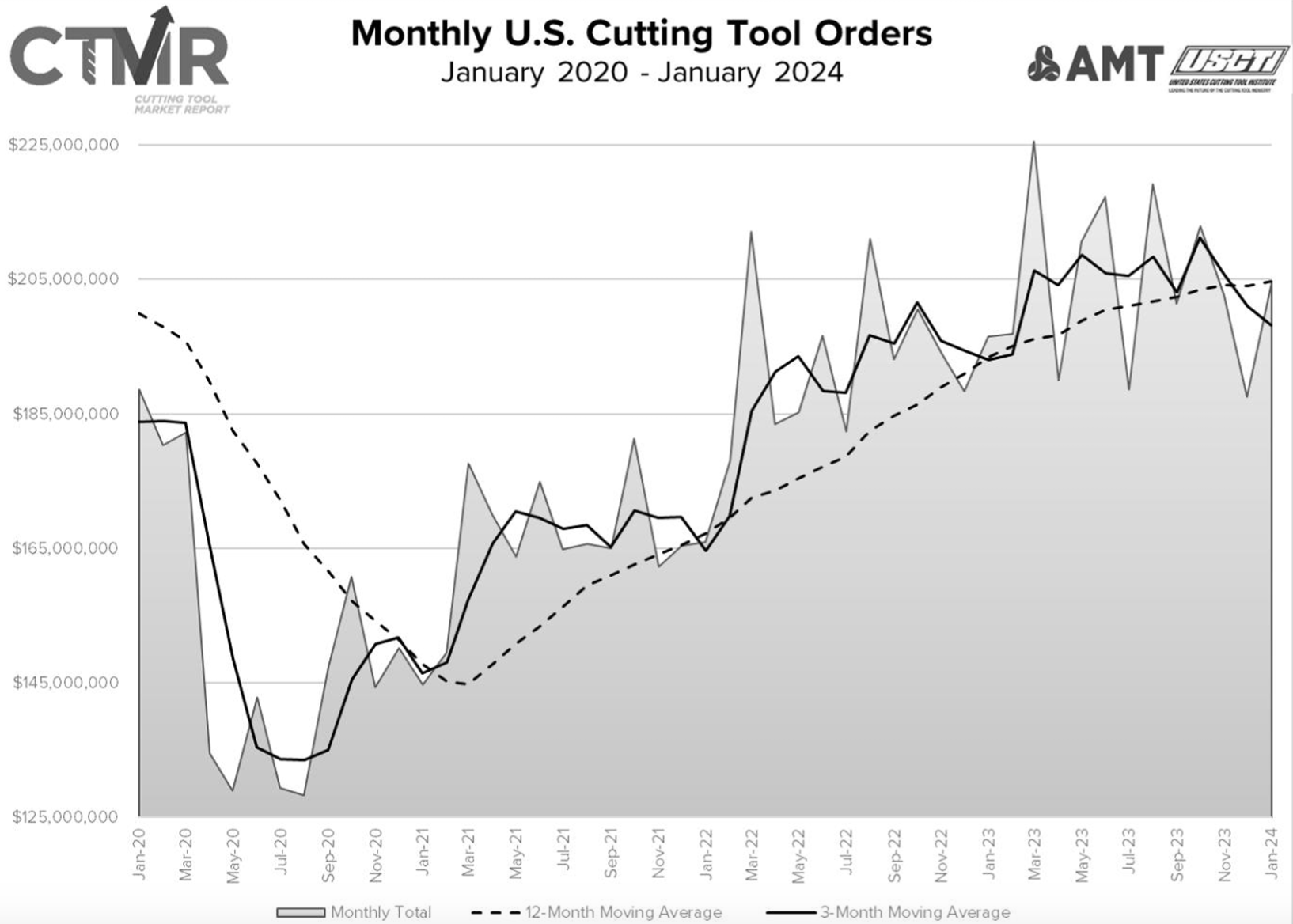

January 2024 U.S. cutting tool consumption totaled $204.5 million, according to the latest Cutting Tool Market Report (CTMR) published by the U.S. Cutting Tool Institute (USCTI) and the Association for Manufacturing Technology (AMT).

That total was up 9.1% from December’s $187.5 million and up 4.1% year-over-year — reversing respective declines of 7.3% and 0.3% in December.

These numbers and all data in this report are based on the totals reported by the companies participating in the CTMR program. The totals here represent the majority of the U.S. market for cutting tools.

“January cutting tool shipments are a good start to 2024 and indicate that the expected decline will not be as severe as some fourth-quarter predictions that were based on the contraction in durable goods spending,” Jack Burley, chairman of AMT’s Cutting Tool Product Group, said in the association’s new CTMR. “Job shops are reporting business activity, and quoting has slowed down some; however, large original equipment manufacturers in automotive, truck, and aerospace are still investing in new production lines. Overall, there is optimism within the industry for continued growth this year.”

The CTMR is jointly compiled by AMT and USCTI, two trade associations representing the development, production and distribution of cutting tool technology and products. It provides a monthly statement on U.S. manufacturers’ consumption of what they tout as the primary consumable in the manufacturing process — the cutting tool.

“January activity started quite slow after the holidays but appeared to recover as the month progressed and carried into February,” added Tom Haag, President of Kyocera SGS Precision Tool. “We are hopeful that the inventory depletions at the close of 2023 are now being replenished to prepare for a solid manufacturing year in 2024. Commercial aerospace has a 10-year backlog to address, and if automotive manufacturing can sort out whether to produce electric vehicles or internal combustion engines, 2024 could prove to be a strong year in metalworking. With 2023 being an exception, we expect the first three months of 2024 to set the tone for the year, barring any geopolitical interruptions.”

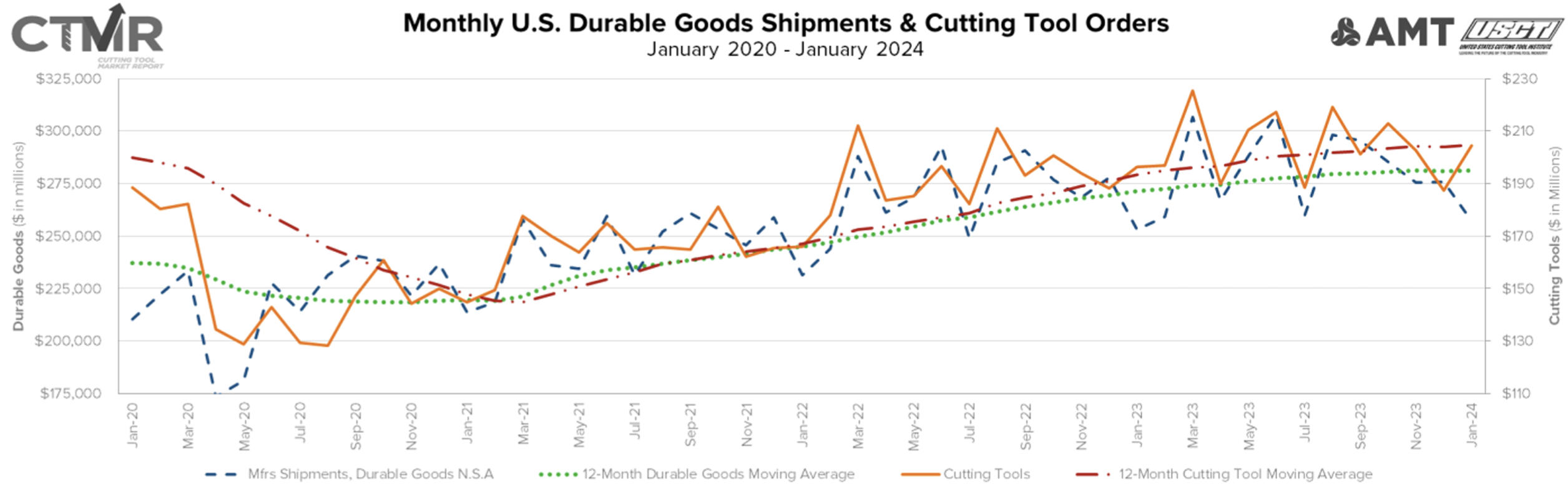

The graph below includes the 12-month moving average for the durable goods shipments and cutting tool orders. These values are calculated by taking the average of the most recent 12 months and plotting them over time.

Related Posts

-

3Q23's uneven growth continued in October, and USCTI's President expects that narrative to continue through…

-

AMT said aerospace and automotive markets are still working on an impressive backlog and sales…

-

It gains WALTER a South Carolina based manufacturer that has roots dating back to 1874.