New orders for U.S.-made durable goods — products meant to last three years or more — sunk 6.1% month-to-month in January, weighed down by a steep decline in bookings for commercial aircraft that was driven by a lull for Boeing passenger planes.

Excluding transportation — down three of the past four months — new orders decreased 0.3%

Economists polled by the Wall Street Journal had forecasted a decline of 5%. It was the sharpest one-month decline since April 2020’s 19.3% plummet amid economic shutdowns at the onset of the COVID-19 pandemic.

The Census Bureau’s monthly advance report issued Feb. 27 showed that new orders for durable goods totaled $276.7 billion in January. It followed a revised 0.3% decline in December (was flat in advance report).

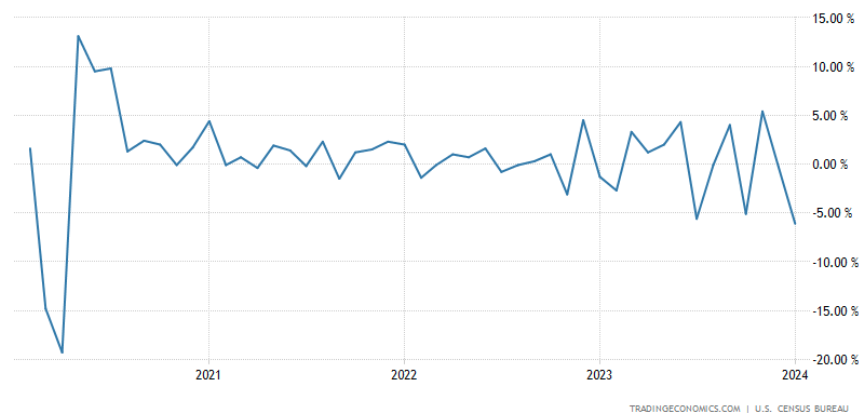

The monthly figure illustrated further recent volatility for durable goods orders, which has alternated a considerable drop or rise with a flat or marginal increase or gain over the past eight months, comprised of three increases between 4.0%-5.4% and three decreases between 5.6%-6.1% and two declines of 0.1 and 0.3%.

Excluding defense, new orders fell 7.3%.

Shipments of manufactured durable goods — down four of the past five months — decreased 0.9% in January month-to-month to $279.0 billion, following a 0.6% December decrease (revised down from advance -0.3%). Transportation likewise drove the decrease with a -3.3% impact.

U.S. Durable Goods Orders, Month-to-Month % Change

source: tradingeconomics.com

source: tradingeconomics.com

Here’s how monthly new orders and shipments of different durable goods product categories fared in January, seasonally-adjusted, according to Census Bureau data:

Primary Metals

- Shipments: -1.0%

- New Orders: -1.7%

Fabricated Metal Products

- Shipments: -0.2%

- New Orders: -0.9%

Machinery

- Shipments: +1.3%

- New Orders: 0.0%

Computers and Electronic Products

- Shipments: +0.3%

- New Orders: +1.4%

Electrical Equipment, Appliances and Components

- Shipments: +2.1%

- New Orders: +0.9%

Transportation Equipment

- Shipments: -3.3%

- New Orders: -16.2%

All Other Durable Goods

- Shipments: -0.1%

- New Orders: -0.5%

Capital Goods

- Shipments: -2.4%

- New Orders: -15.0%

Related Posts

-

Following their biggest gain in 28 months during November, orders were virtually unchanged in December.

-

It was a major reversal from September’s 4.0% gain, and the second considerable drop in…

-

Machinery, up four of the last five months, led the increase at $0.2 billion or…