After a January that brought optimism about resilience in the U.S. industrial economy, February’s Manufacturing Purchasing Managers Index reverted to a now longstanding downtrend that reflects broad weakened demand.

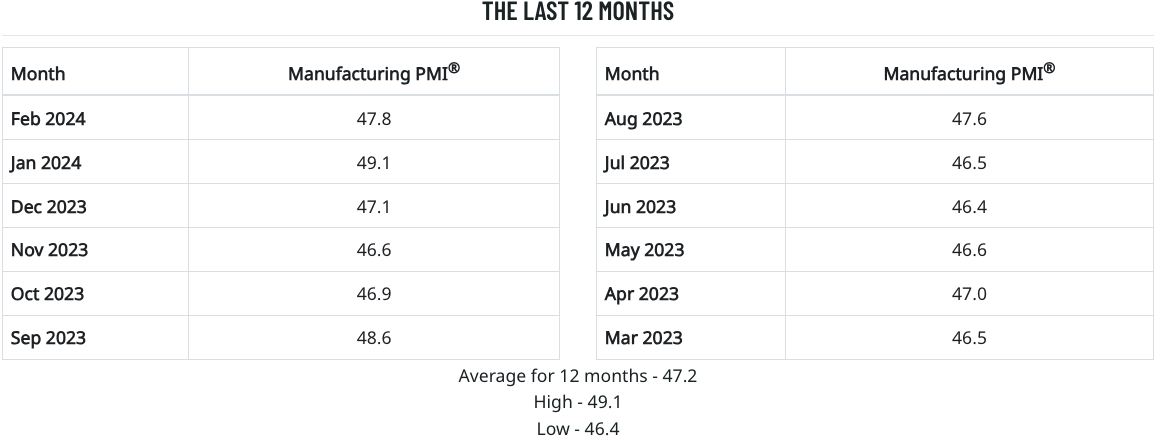

Issued March 1, February’s PMI from the Insititute for Supply Management showed a reading of 47.8% — down 1.3 percentage points from January’s that jumped 2.0 points month-to-month to its highest mark since October 2022 (50.2%).

It was the 16th straight month that the PMI was in contraction territory (anything below 50.0%) and indicated that the U.S. industrial economy contracted at a faster pace than in January.

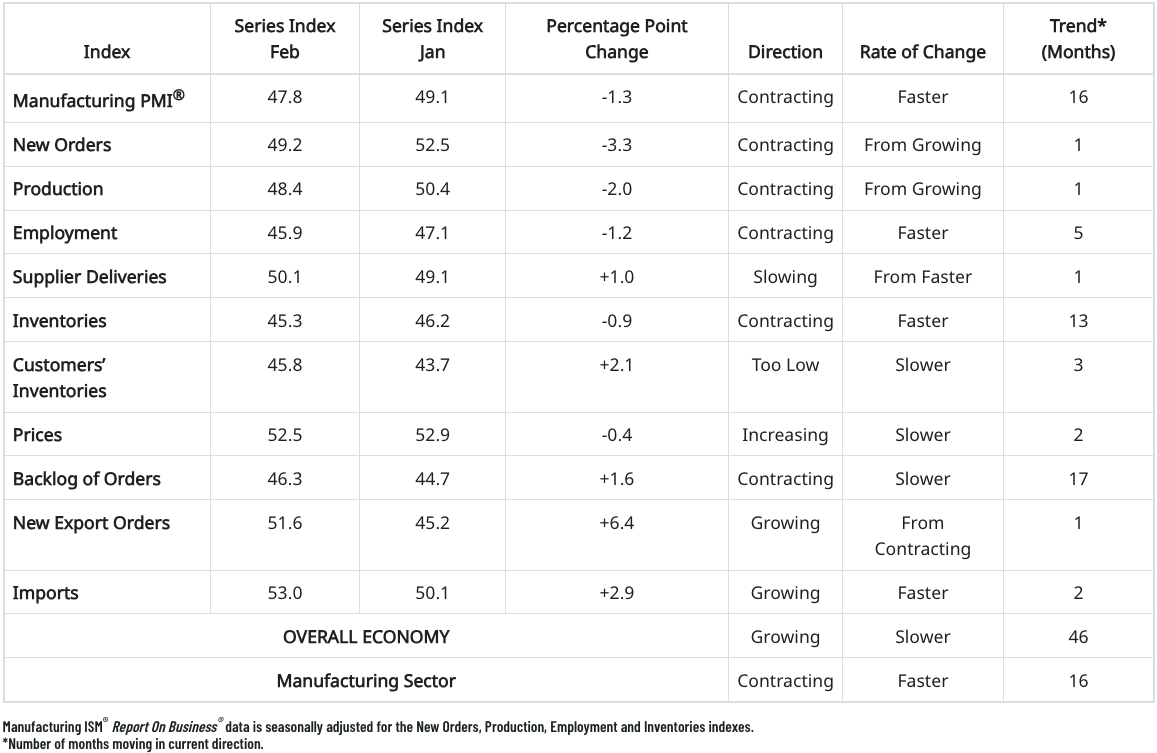

Of the PMI’s 10 factoring indices, five trended negatively month-to-month in February, led by New Orders (-3.3 points to 49.2%) and Production (-2.0 to 48.4%) both falling from expansion into contraction territory. Employment (-1.2 to 45.9%), Inventories (-0.9 to 45.3%) and Prices (-0.4 to 52.5%) also fell. Supplier Deliveries (+1.0 to 50.1%) and New Export Orders (+6.4 to 51.6%) moved from contraction to expansion territory, while Customers’ Inventories (+2.1 to 45.8%), Backlog of Orders (+1.6 to 46.3%) and Imports (+2.9 to 53.0% also improved.

Supplier deliveries is the only index that is inversed – a reading above 50.0 indicates slower deliveries, which ISM notes is typical as the economy improves and customer demand increases.

Manufacturing at a Glance – February 2024

“Demand is at the early stages of recovery, and production execution is relatively stable compared to January, as panelists’ companies begin to prepare for expansion,” ISM Chair Timothy Fiore said in the institute’s February Manufacturing PMI report. “Suppliers continue to have capacity but are showing signs of struggling, due in part to their raw material supply chains.”

Fiore added that 40% of manufacturing GDP contracted in February, down from 62% in January and 84% in December. Meanwhile, the share of sector GDP registering a composite PMI calculation at or below 45% — noted as a reliable barometer of overall manufacturing weakness — was just 1% in February, compared to 27% in January and 48% in December.

Three the six biggest manufacturing industries — Fabricated Metal Products, Chemical Products and Transportation Equipment — registered growth during February, compared to two in January. Among the top six industries by contribution to manufacturing GDP in February, none had a PMI at or below 45%, compared to two in January.

Eight manufacturing industries reported growth in February, compared to four in January: Apparel, Leather & Allied Products; Nonmetallic Mineral Products; Primary Metals; Plastics & Rubber Products; Fabricated Metal Products; Chemical Products; Miscellaneous Manufacturing; and Transportation Equipment

Survey Commentary

Here is a sampling of PMI survey respondent commentary that ISM provided for February:

- “Currently seeing increasing sales in our business. Most delivery dates are in the second quarter of 2024.” [Chemical Products]

- “The first quarter will be slower due to some customer order changes, but we are expecting the rest of 2024 to be strong. We may increase our growth projections.” [Transportation Equipment]

- “Typical first quarter volume drops from fourth quarter high volumes. Additional distribution has allowed us to maintain consistent production shifts.” [Food, Beverage & Tobacco Products]

- “Customer softness continues in China, Japan and Europe.” [Computer & Electronic Products]

- “Demand has finally picked up, with customer orders more closely resembling typical January and February levels. January was up 22 percent compared to December; February up 26 percent compared to January.” [Machinery]

- “Customer orders are steady, neither up nor down compared to last month. This steady state is what we budgeted and forecast. We are forecasting business to increase 2 percent to 4 percent over the next couple of months.” [Fabricated Metal Products]

- “Business outlook overall is stable. Working through customer backlog with some raw material lead times improving.” [Miscellaneous Manufacturing]

- “We reflected on 2023 for maybe a minute and turned the page forward to 2024. Weather in January caused several operations to be idle, and shipments were affected.” [Nonmetallic Mineral Products]

- “The month seems to be getting stronger with each passing day and week. Lots of market volatility —pricing flat to downward. It will be interesting to see how the last days of the month play out, as indications seem to be all over the place.” [Primary Metals]

- “We are experiencing increased sales, which is putting pressure on the plant and assembly to meet new customer demand.” [Electrical Equipment, Appliances & Components]

Related Posts

-

January's figure still indicated contraction for a 14th consecutive month, but at a much slower…

-

Threadline Products opened a new headquarters to meet growing demand and combine operations of a…

-

The figures indicate that demand remains soft and production execution was slightly down compared to…