A key U.S. industrial economy barometer trended considerably positive to start February, as the Institute for Supply Management’s monthly Manufacturing Purchasing Managers Index (PMI) showed a 2-percentage point increase in January — pushing it close to breakeven after a prolonged period of contraction.

Issued Feb. 1, the January PMI showed a reading of 49.1%, up from November’s 47.1%. It was its highest mark since October 2022’s 50.2%, and well above forecasts of approximately 47.0%.

Though January’s reading continued to indicate contraction — any reading below 50.0% — in the manufacturing sector for a 14th consecutive month, it was at a much slower pace than December and nearly all of 2023.

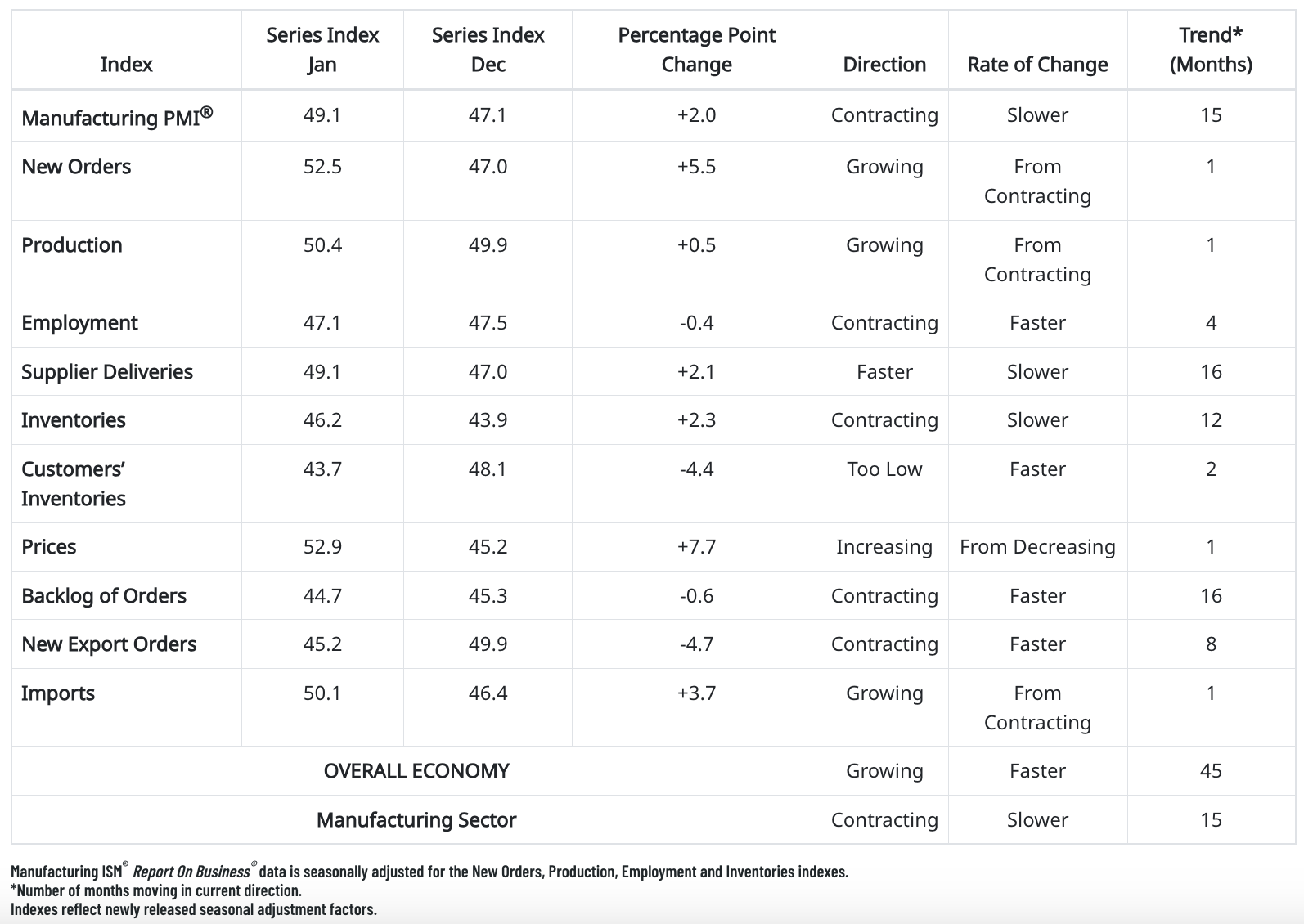

Of the PMI’s 10 factoring indices, seven trended positively month-to-month in January: New Orders (+5.5 points to 52.5%), Production (+0.5 to 50.4%), Prices (+7.7 to 52.9%) and Imports (+3.7 to 50.1%) all moved from contraction into expansion territory, while Supplier Deliveries and Inventories also improved. Employment, Customers’ Inventories and New Export Orders declined.

Supplier deliveries is the only index that is inversed – a reading above 50.0 indicates slower deliveries, which ISM notes is typical as the economy improves and customer demand increases.

Manufacturing at a Glance – January 2024

Two of the six biggest manufacturing industries — transportation equipment and chemical products — registered growth.

“Demand remains soft but shows signs of improvement, and production execution is stable compared to December, as panelists’ companies continue to manage outputs, material inputs and labor costs,” said Timothy Fiore, Chair of the ISM Manufacturing Business Survey Committee. “Suppliers continue to have capacity.”

Fiore added that 62% of manufacturing GDP contracted in January, down from 84% in December. Meanwhile, the share of sector GDP registering a composite PMI calculation at or below 45% — noted as a reliable barometer of overall manufacturing weakness — was 27% in January, compared to 48% in December and 54% in November.

Among the top six industries by contribution to manufacturing GDP in January, two (Machinery; and Computer & Electronic Products) had a PMI at or below 45%, one fewer than in the previous month.

The four manufacturing industries reporting growth in January are: Apparel, Leather & Allied Products; Textile Mills; Transportation Equipment; and Chemical Products.

Survey Commentary

Here is a sampling of PMI survey respondent commentary that ISM provided for January:

- “The start of 2024 looks good. Sales are above expectations, and costs are mostly stable. A few commodities are up in cost due to supply shortages. Many previously short commodities market positions have corrected themselves. There is a real short-term increase in the cost of international freight.” [Chemical Products]

- “The commercial vehicle market appears to be retracting a bit in 2024 compared to last year. Forecast sales have decreased slightly in most product segments, with only limited growth related to customers’ competitive sourcing and moves to new technology. Most supply chains, including for semiconductors, have stabilized, with the only major escalation now being transit through the Red Sea.” [Transportation Equipment]

- “Business continues to stabilize. Cash flow will be tight in 2024.” [Food, Beverage & Tobacco Products]

- “U.S. economic outlook is affecting customer orders, and the current backlog is quite low compared to past quarters. Waiting on potential improvements from the CHIPS and Science Act.” [Computer & Electronic Products]

- “December sales were very strong but slower for the first part of January, as was expected. We expect to see steady sales going forward, if the (U.S. Federal Reserve) continues to hold rates and suggests a rate cut in the future.” [Machinery]

- “Good start to the year. We had budgeted a 3.5-percent increase over 2023. We expect it to be a challenging year. Currently, orders are positive in our automotive OEM and automotive aftermarket business. Our industrial business sector is looking weak at the moment. Still expect to achieve budget forecasts through the first quarter. (We) feel January is running high for automotive because at the end of December, many OEMs cancelled the last few weeks of orders to reduce inventory levels.” [Fabricated Metal Products]

- “Order backlog, which was at historically high levels, is diminishing due to supply chain improvements and slight slowdown of orders.” [Miscellaneous Manufacturing]

- “Demand continues to be slow. Reduction from the second half of 2023 has continued into this year. We are adjusting production to match demand.” [Electrical Equipment, Appliances & Components]

- “Current industry conditions are positive; however, a note of caution as we see potential headwinds with downward price movements in the coming months.” [Primary Metals]

- “Remarkable slowdown in business in December. January has picked up, but not to previous-year levels.” [Textile Mills]

Related Posts

-

While in contraction territory for a 10th straight month, a handful of key subindexes trended…

-

The latest data shows a reading of 49% for September, the 11th straight month that…

-

Threadline Products opened a new headquarters to meet growing demand and combine operations of a…