The U.S. manufacturing sector contracted in November for a 13th consecutive month after a 28-month period of growth, and by the same rate as October. That’s according to the Institute for Supply Management’s latest Manufacturing ISM Report on Business, from which its monthly Purchasing Managers Index (PMI) is a well-regarded barometer for the health of U.S. manufacturing.

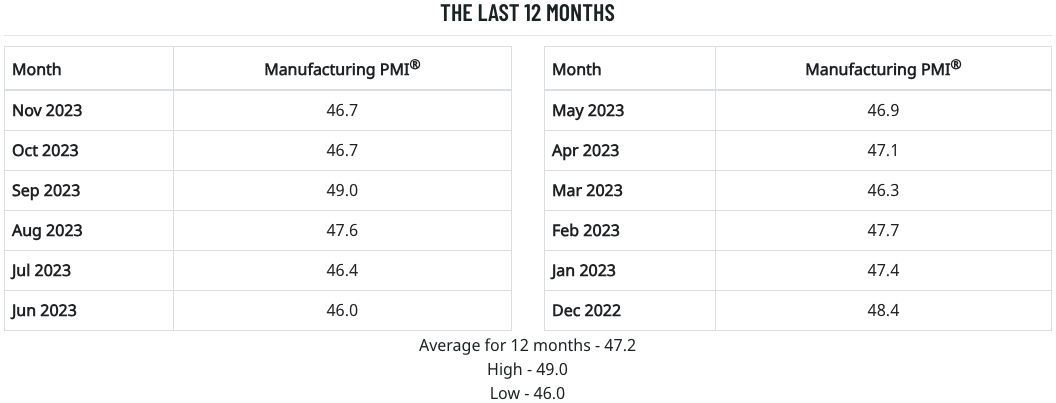

Shared Dec. 1, the November PMI showed an overall figure of 46.7%, identical to October. Any PMI reading below 48.7% indicates contraction over a period of time. The past two months of contraction followed one month of slight expansion in September (49.0%), while the previous nine months were all in contraction territory, preceded by 30 straight months of expansion.

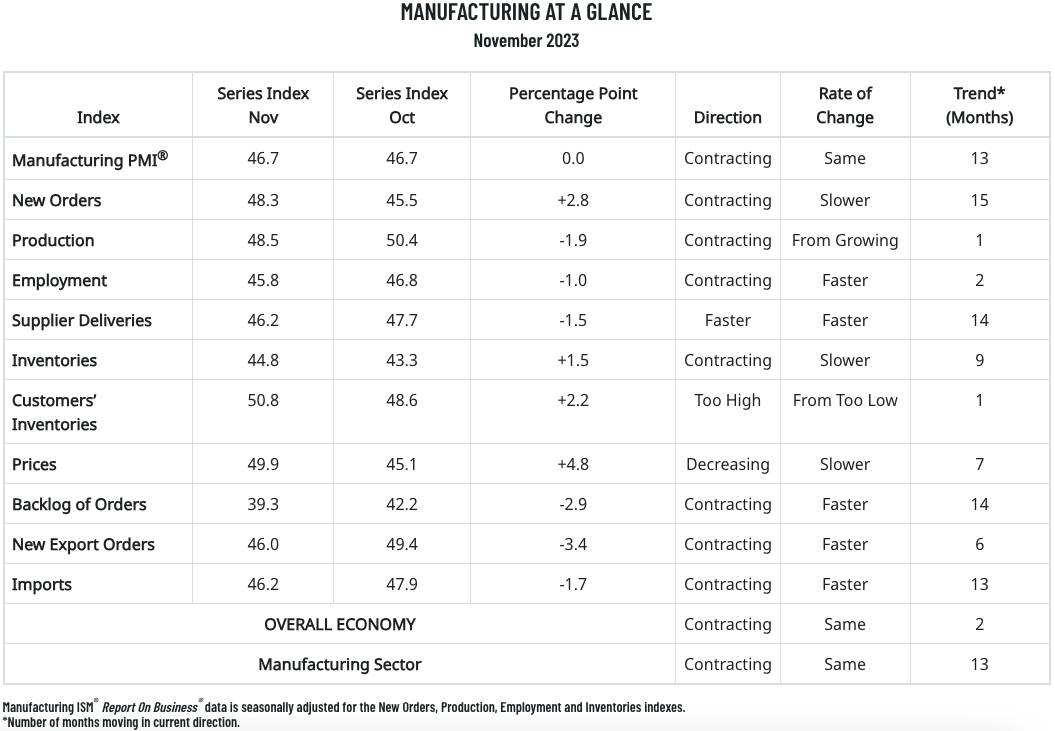

Of the PMI’s 10 factoring indices, six moved lower during November vs. October. The index for new orders gained 2.8 percentage points to 48.3, indicating slower contraction, while the indices for production (-1.9), employment (-1.0) and supplier deliveries (-1.5) each trended downward.

Inventories (+1.5), customer inventories (+2.2) and prices (+4.8) each increased from October, while backlog of orders (-2.9), new export orders (-3.4) and imports (-1.7) each moved further into contraction.

“Demand remains soft, and production execution is slightly down compared to October as panelists’ companies continue to manage outputs, material inputs and — more aggressively — labor costs,” stated Timothy Fiore, Chair of the ISM Manufacturing Business Survey Committee. “Suppliers continue to have capacity. Sixty-five percent of manufacturing gross domestic product (GDP) contracted in November, down from 75 percent in October.”

Fiore continued that the share of sector gross domestic product registering a composite PMI calculation at or below 45% — a good barometer of overall manufacturing weakness — was 54% in November, compared to 35% in October and 6% in September. Three of the top six industries by contribution to November GDP were at or below 45% in November, the same as in October.

Of the 17 manufacturing industries that ISM tracks, only three manufacturing reported growth in November: Food, beverage & tobacco products; Nonmetallic mineral products; and transportation equipment.

Here is a sampling of PMI survey respondent commentary that ISM provided for November:

- “Economy appears to be slowing dramatically. Customer orders are pushing out, and all efforts are being made to right-size inventory levels, both to mitigate carrying costs on pushed-out orders and to load up on inventory where costs are exploding, like cold-rolled steel.” [Computer & Electronic Products]

- “Starting to feel softening in the economy, with labor still a challenge to backfill critical roles. The 2024 forecast looks challenging, specially from a cost perspective.” [Chemical Products]

- “Nearly all microchip supply issues have been resolved, finally bringing an end to the three-year chip shortage. Material prices are remaining relatively flat. Supply chain issues continue in several areas, resulting from difficulties during the United Auto Workers (UAW) strike.” [Transportation Equipment]

- “Our executives have requested that we bring down inventory levels considerably, and it has started causing customer shortages. Both finished goods, and low inventories of raw and packing materials are creating issues in fulfilling customer demand, and in some cases causing serious (production) delays.” [Food, Beverage & Tobacco Products]

- “The end of the major construction season and an early pullback in customer capital expenditures purchases have resulted in a lower backlog in the fourth quarter.” [Machinery]

- “Automotive sales still impacted by UAW strike. Still waiting for orders to come in, and we also need to work down inventory levels that increased during the strike period. This will most likely happen in December.” [Fabricated Metal Products]

- “Customer orders have pushed into the first quarter of 2024, resulting in inflated end-of-year inventory.” [Miscellaneous Manufacturing]

- “(Our situation is) good but guarded, as next year is hard to predict. There are undertones of uncertainty in the market and the impact of inflation on maintenance and project costs has become apparent.” [Nonmetallic Mineral Products]

- “Customers back online after the UAW strike. Consuming inventory that was built as a strike bank. Still (having) issues with hiring quality candidates for both hourly and salaried positions. Current inventory levels are too high, but the order book remains strong.” [Primary Metals]

- “Elevated financing costs have dampened demand for residential investment. Our business has been negatively impacted through reduced new orders for our products and services. We are purchasing less for production and finished goods inventories.” [Wood Products]

Related Posts

-

For a second straight month, none of the PMI's 10 subindexes registered monthly expansion.

-

The 2023 NAFCD + NBMDA Annual Convention will be held in Colorado Springs, Colorado, from…

-

Following July's considerable 1.0% monthly gain, August was held by somewhat by a drop in…