Editor’s Note: This is a preview of the full Premium article. Click here to access the full Premium in-depth article.

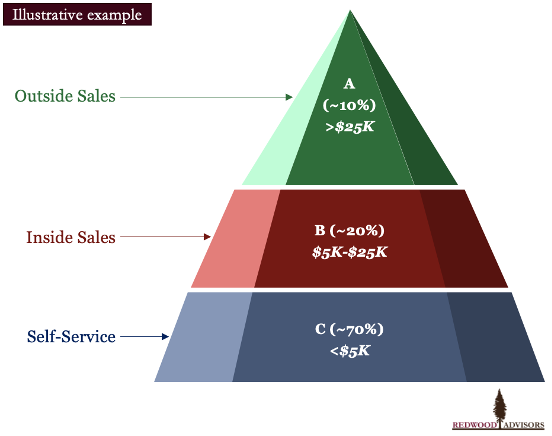

Most distributors have a significant opportunity to drive top and bottom-line growth by optimizing their go-to-market (GTM) strategy and approach, particularly their outside and inside sales forces. Many distributors have invested in an expensive sales force, but it’s not optimized — and that puts senior management at risk. In this article by Redwood Advisors, learn about the first key step to getting this right: best-in-class customer segmentation.

In our experience, refreshing and refining your customer segmentation may be the most critical step in optimizing a distributor’s go-to-market approach, yet it is often overlooked. In general, distributors cannot effectively redesign and optimize their GTM approach and sales organization without a thoughtful, quantitative, and ideally rigorous update of their customer segmentation. This is the first key step in the overall process.

Each distributor should approach customer segmentation differently. A one-size-fits-all approach simply does not work well for most distributors. Consequently, we recommend distributors build out a customized segmentation approach that provides important, practical insights on how to best sell, serve, and support different types of customers. Important dimensions vary by distributor and often include product portfolio areas (i.e., buckets of similar products), consumables vs. durables bought (both overall sales and % of sales by customer), additional services sold (if any), region, cost-to-serve, and margin profile to name some of the most common, customized categories.

While we do recommend building out a customized, insightful segmentation model, we generally find that four dimensions represent a powerful starting point for segmenting distributor customers: (1) customer size or value, (2) customer-level product mix, (3) customer purchasing pattern (i.e., how they buy whether online, in-person, etc.), and (4) estimated share of wallet. Not every distributor has these data points, and getting these data points often requires data gathering, analysis, and estimation. But this almost always proves to be a highly valuable exercise as these four dimensions powerfully highlight differences between customers – and how different types of customers can and should be best sold and serviced.

The first dimension is customer size or value. This is a critical dimension and one that’s been used by distributors to segment customers for decades. You can measure customer size (or value) in terms of revenue, gross margin, or net margin. In general, we find that gross margin (if available) often represents the best metric to use.

The next dimension is customer-level product mix. This gets at what specifically each customer is purchasing from you. In our experience, most distributors have several meaningfully different segments based just on what products or services different customers buy. For this dimension, we recommend reviewing what % of sales come from each category. For example, some customers largely buy lower-cost, higher-volume products (e.g., tapes, blades, wheels, lines) while others spend significant amounts on larger, durable products or pieces of heavy equipment that can help improve output, productivity etc.

The third segmentation dimension is how each customer makes their purchases. In other words, you want to understand what sales channel(s) a customer usually uses to make purchases. This segmentation often meaningfully informs later phases of work with customers who largely purchase online or via retail locations often making better candidates for self-service or inside sales than outside sales.

Finally, if possible, we often see a significant amount of value in analyzing customers based on your estimated share of wallet. This is often the most difficult of the four dimensions to estimate as few customers are willing to voluntarily share how much they spend in the product and service portfolio a distributor offers. But this does not mean this cannot be done. For purposes of this analysis, we recommend and often find that high-level estimates of share of wallet can work really well, particularly for those customers serviced by a sales rep today.

Taken together, these four dimensions create a strong foundation for insightful and highly useful customer segmentation — and provides an in-depth view of your customers and how to best interact with them. All this then represents the critical input to an optimized GTM strategy and approach. Powerful customer segmentation is a key first step to unlocking a significant opportunity to drive top and bottom-line growth, particularly through best-in-class outside and inside sales forces. We highly recommend investing real time and resources on this step as everything that comes later is based on the rigor and comprehensiveness of the segmentation work.

About the Authors

John Nantz has delivered over 75 projects as a management consultant over the last 10 years with a focus on growth strategy and commercial excellence for distributors, manufacturers, and other clients. Former clients include GranQuartz, Ares Private Equity, and McElroy Manufacturing among others. John started his career at McKinsey & Company’s San Francisco office and earned a BA with distinction in Economics and an MS in Management Science & Engineering from Stanford University.

Sabrina Franco is an Associate Consultant at Redwood Advisors where her work focuses largely on growth strategy and commercial excellence for distributors, manufacturers, and other clients. Former clients include GranQuartz in the stone industry. Sabrina graduated cum laude from the Honors Program at Southern Methodist University with a BA in History and a BS in Applied Mathematics.

Related Posts

-

Net Results Group Managing Partner Lance Gilbert discusses the state of indirect spend at large…

-

The company said 4Q sales were $260.5 million — down 0.6% from the same quarter…

-

Customers want to see that they’re supporting businesses that share similar values. Thus, “customer transparency”…