Companies have the most difficulty with a lack of consistent pricing across channels, technology issues and poor online customer experience. Read More.

Companies have the most difficulty with a lack of consistent pricing across channels, technology issues and poor online customer experience. Read More.

Subscribers should log-in to read this article.

Subscribers should log-in below to read this article.

Subscribers should log-in below to read this article.

Subscribers should log-in below to read this article.

Subscribers should log-in below to read this article.

Subscribers should log-in below to read this article.

Subscribers should log-in below to read this article.

Subscribers should log-in below to read this article.

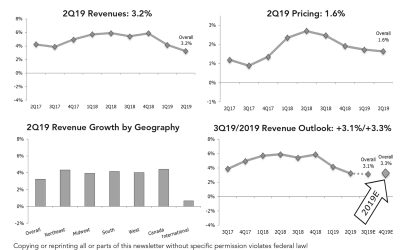

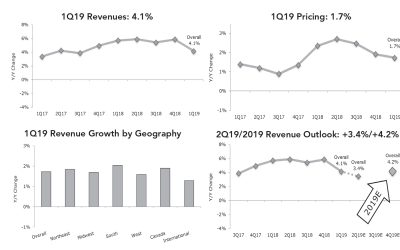

Since 2010, Robert W. Baird & Co., in partnership with Modern Distribution Management, has conducted quarterly surveys of distributors and manufacturers to gauge business trends and the outlook for the industry. This quarter’s survey polled approximately 500 industry leaders to determine the latest indicators on revenue and pricing based on first-quarter 2019 results and distributor and manufacturer expectations for second-quarter and full-year 2019.

Subscribers should log-in below to read this article.

By providing your email, you agree to receive announcements from us and our partners for our newsletter, events, surveys, and partner resources per MDM Terms & Conditions. You can withdraw consent at any time.

Wholesale distribution news and trends delivered right to your inbox.

Sign-up for our free newsletter and get: