While business conditions in most industrial and commercial wholesale distribution markets haven’t sunk to anywhere near the downtrodden levels widely predicted at this time a year ago, product demand remains soft for most.

We at MDM continue to hear widespread optimism from distributors about their revenue prospects for 2024 — particularly in the second half — while they’ve acknowledged a market slowdown since at least the midpoint of 2023 following bumper revenue years in 2021 and 2022.

The MDM Forecast pinpointed 2023 U.S. wholesale distribution revenue at $7.903 trillion, down 1.6% from its high-water mark of $8.031 trillion in 2022. And while we’re forecasting 2024 growth of 2.8% and an even better 2025, most distributors can expect lasting demand softness for another quarter.

While sequential revenue growth may currently be an uphill battle, this period of weakened demand presents opportunities for distributors to right-size their inventory. That was the focus of our latest MDM Podcast, which featured a conversation between MDM’s Tom Gale and James Dorn and John Gunderson of distributor and manufacturer consultant firm Dorn Group.

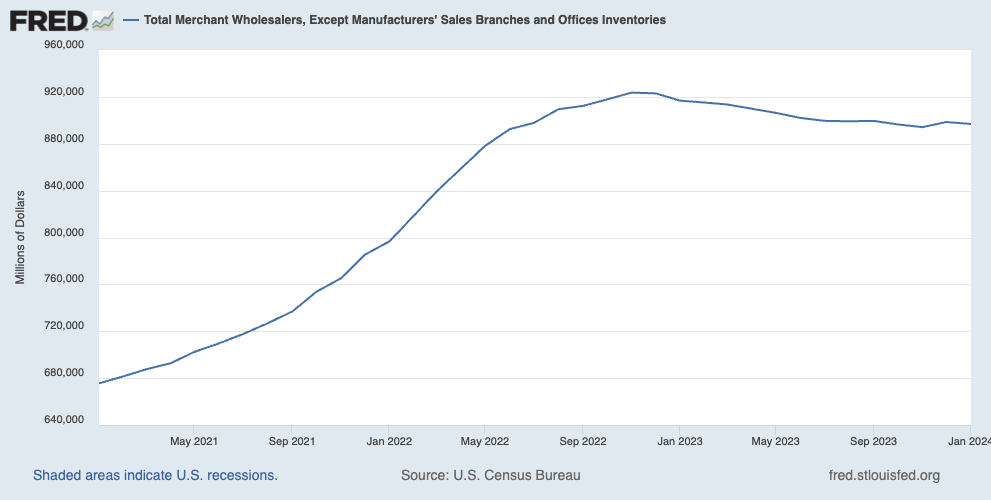

Amid the ongoing product demand slowdown since late 2022, distributors have been in inventory off-load mode, whether due to the onset of slower sales, several years of industry fervor about a looming recession, or both. The U.S. Census Bureau’s March 6 Wholesale Trade report indicated that January 2024 wholesale inventories were valued at $897 billion — down about 3.6% from its late 2022 peak, with relatively flat inflation in that same stretch.

Gunderson recounted when he would visit branches of electrical and plumbing supplies distributor Hughes Supply — acquired by HD Supply in 2006 for $3.2 billion and then acquired by Hajoca in 2011 — he would see posters around the facility depicting the company’s founding brothers Harry and Russell Hughes standing in front of a 1920s Ford Model T truck, with a phrase beneath them that said, “You can’t sell from an empty wagon.”

“I think that says it all about inventory and distribution,” said Gunderson, who formerly was MDM’s Vice President of Analytics and and E-Business. “That’s 100-year-old photo, but it really is the key of what we’re talking about on how a lot of distributors and manufacturers are struggling with inventory levels right now.”

Gunderson authored a three-part “Fastenal’s Big Pivot” series published on MDM during November and December 2023 — with each part ending up in our 10 most-read blogs of 2023. Stay tuned for a forthcoming report that packages those three pieces into a convenient PDF download. Gunderson and Gale discussed that series in a February MDM Podcast.

Gunderson detailed how distributors’ current inventory glut was built by orders that were based on outdated demand levels and double-ordering spurred by product shortages coming out of the COVID-19 pandemic. The resulting high stock levels created a need for optimization.

What’s pressuring distributors today, Gunderson added, was the need for both inventory breadth and depth. Having a wide selection of product SKUs doesn’t mean much if you don’t have the quantities needed to meet simultaneous demand for the same product.

“My first boss used to say that the quickest way for a distributor to go from the penthouse to the outhouse in a local market is to screw up your inventory and not have enough depth,” Gunderson said. “It creates a bad impression, and they (customer) go down the street to fill that order.

To solve this, Dorn detailed, distributors and manufacturers can work together to segment their inventory based on how fast different products move through demand — often in a A-B-C-D format, where As and Bs are faster-moving than Cs and Ds. This helps right-size inventory by measuring levels in both SKU counts and in working capital.

“Nine times out of 10 when we help distributors do this, they’re reducing the amount of inventory they have in slow-moving SKUs and they’re reallocating that capital to faster-moving SKUs. That’s an opportunity for both sides to work together,” Dorn said.

And just because inventories are higher than current demand, it doesn’t mean a discounted fire sale is needed, Dorn advised. Sometimes, inventory just hasn’t caught up with the demand cycle. Dorn recounted the latest fiscal quarterly filing from Rockwell Automation that indicated that the manufacturer has excess inventory in the channel, but underlying demand from machine builders and end users remains strong.

“This is a good indicator that the channel and end customers are simply just working through higher levels of inventory, but that the demand is still there,” Dorn said.

Distributors don’t want to be caught flat-footed if ff demand picks up faster than expected in the second half of 2024, so right-sizing inventory levels would figure to be a priority right now, and one we at MDM will continue to monitor in the months ahead.

Listen to the full podcast via the audio player above, and you can find all of our previous MDM Podcast episodes here.

Related Posts

-

NAW’s 2024 Executive Summit was its most well-attended such event in years, and its content…

-

NAW’s Bart Tessel and Applico’s Alex Moazed share thoughts on distribution innovation and technology today…

-

Leadership has been a critical differentiator for how well a distribution firm has performed over…