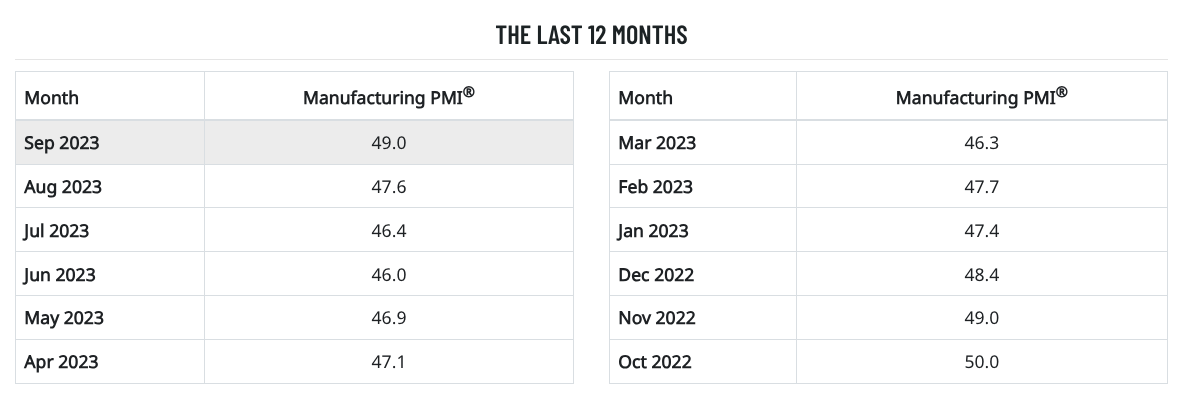

The Institute for Supply Management (ISM) released its monthly Manufacturing ISM Report on Business on Oct. 1, showing that September PMI improved to a 10-month high.

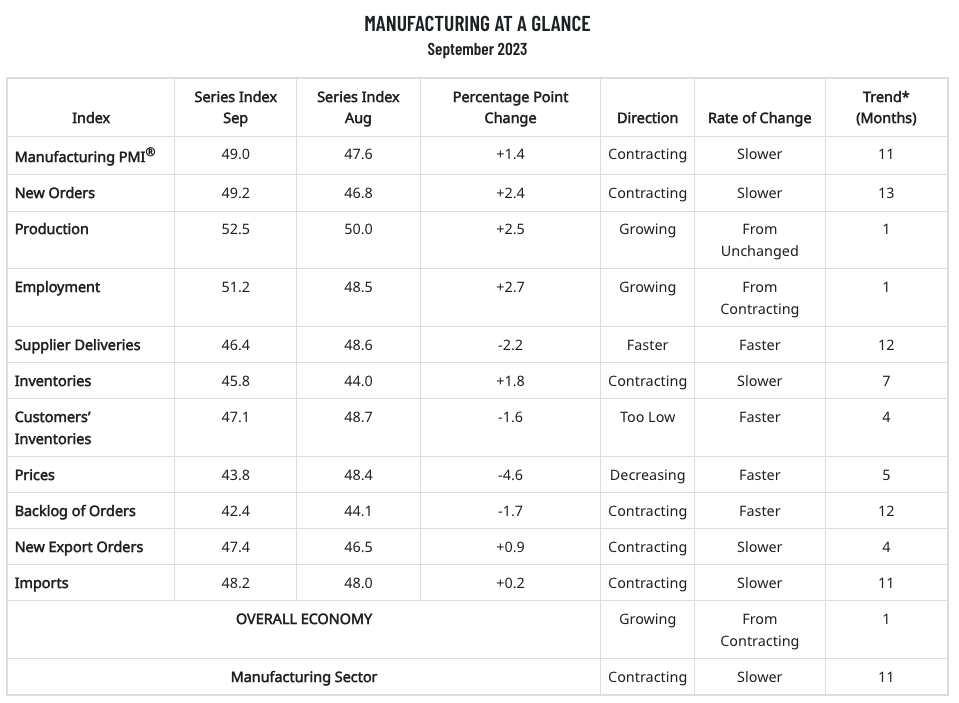

ISM’s September Producer Manufacturing Index (PMI) showed a reading of 49%, 1.4 percentage points higher than the 47.6% recorded in August. It was the 11th straight month that the PMI was in contraction (anything below 50.0%).

The overall economy expanded weakly after nine months of contraction following a 30-month period of expansion coming out of COVID-19 pandemic-driven industry shutdowns, according to ISM.

The New Orders Index remained in contraction territory at 49.2%, 2.4 percentage points higher than the figure of 46.8% recorded in August. The Production Index reading of 52.5% is a 2.5-percentage point increase compared to August’s figure of 50%.

The Prices Index registered 43.8%, down 4.6 percentage points compared to the reading of 48.4% in August. The Backlog of Orders Index registered 42.4%, 1.7 percentage points lower than the August reading of 44.1%. The Employment Index registered 51.2%, up 2.7 percentage points from the 48.5% reported in August.

In addition, the Supplier Deliveries Index figure of 46.4% for September is 2.2 percentage points lower than the 48.6% recorded in August.

For September, the Inventories Index increased by 1.8 percentage points to 45.8%; the August reading was 44%. The New Export Orders Index reading of 47.4% is 0.9 percentage point higher than August’s figure of 46.5%. The Imports Index remained in contraction territory, registering 48.2%, 0.2 percentage point higher than the 48% reported in August.

For September, the Inventories Index increased by 1.8 percentage points to 45.8%; the August reading was 44%. The New Export Orders Index reading of 47.4% is 0.9 percentage point higher than August’s figure of 46.5%. The Imports Index remained in contraction territory, registering 48.2%, 0.2 percentage point higher than the 48% reported in August.

“The U.S. manufacturing sector continued its contraction trend but at a slower rate, recording its best performance since November 2022, when the PMI also registered 49%,” said Timothy R. Fiore, ISM Chair. “Companies are still managing outputs appropriately as order softness continues, but the month-over-month PMI improvement in September is a clear positive. Demand eased marginally, with the (1) New Orders Index contracting, though at a slower rate, (2) New Export Orders Index continuing in contraction territory but with a marginal increase, and (3) Backlog of Orders Index declining. The Customers’ Inventories Index reading indicated improved supply chain efficiency, as output improved and customers’ inventories continued to decline.”

Of the six largest manufacturing industries, two — Food, Beverage & Tobacco Products; and Petroleum & Coal Products — registered growth in September, Fiore said.

Here is a sampling of ISM manufacturing PMI survey respondent commentary for September:

- “In the evolving supply chain environment, customers are increasingly taking an active role in initiating new projects, looking for cost reduction opportunities and lead-time mitigation, with a growing emphasis on collaboration. Post-pandemic, customers have learned they need partners to navigate rough waters.” [Computer & Electronic Products]

- “We need to coordinate very closely with suppliers in order to yield a more cost-competitive offer. More back and forth is needed to reach a reasonable total price.” [Chemical Products]

- “Orders and production remain steady, and we are maintaining a healthy backlog. Continued inflation and wage adjustments continue to drive prices up, although we should get some relief from the markets stabilizing.” [Transportation Equipment]

- “Cost increases are now generally isolated to specific commodities rather than blanket increases due to ‘inflation.’ ” [Food, Beverage & Tobacco Products]

- “Markets remain soft. Our customers have about-right inventory levels, but they paid more due to pandemic cost increases. Everyone is holding off on increasing inventories, hoping they can buy at lower costs.” [Apparel, Leather & Allied Products]

- “Overall, things continue to be very steady: Sales and revenue are as expected, and the supply environment has stabilized greatly versus 2021-22. Some things to watch include the Panama Canal (drought), U.S.-China relations, and the impact the UAW (United Auto Workers) strike could have on suppliers of ours who support automotive production. But overall conditions feel stable.” [Miscellaneous Manufacturing]

- “Cement negotiations have changed, with cement mills no longer offering annual or guaranteed pricing. We now want to contract more as a commodity, leaning toward quarterly, with fluctuating prices yet to be determined.” [Nonmetallic Mineral Products]

- “A recession feels imminent. Money continues to be pushed into the bank markets, driving inflation rates really high. Most plants are buying less material or reducing consumption in the name of sustainability, as well as running at 80 percent of capacity. Prices of some products may increase for the upcoming winter weather.” [Petroleum & Coal Products]

- “Business conditions and market demand remain strong. We are projected to be at capacity in the next 12 months.” [Primary Metals]

- “New business development is coming onboard. However, many forecasts are set for the beginning of 2024. Hiring and retaining quality people is still a struggle.” [Textile Mills]

Related Posts

-

For a second straight month, none of the PMI's 10 subindexes registered monthly expansion.

-

Total inventories of merchant wholesalers were $902.3 billion at the end of July, down 0.2%…

-

Sales of merchant wholesalers, after adjustment for seasonal variations and trading day differences but not…