Financial markets and economic news continue to focus national media attention on what analysts and economists paint as an increasing inevitability of a recession. Not so fast. The third quarter Baird-MDM survey of 500 industrial and construction supply distributors, representing more than $100 billion in revenues, indicates continued strong demand.

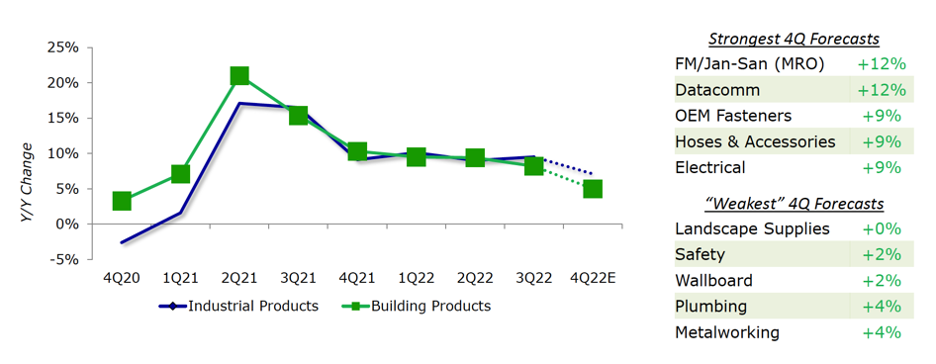

Survey respondents indicate slightly moderating growth from the second quarter, but with year-to-year revenue growth for the third quarter at more than 9%, and fourth quarter revenue estimates at 6.4%. And distribution executives surveyed remain bullish on 2023 forecast revenues at 5.6% annual growth over 2022.

MDM Premium Members: Watch for your quarterly MarketPulse Baird-MDM survey results in your inbox that profiles in-depth revenue and pricing data and forecasts by distribution executives across 20 industrial and building products sectors.

That positive sentiment has been reinforced at every conference our team at MDM has attended over the past two months. The survey and more recent anecdotal comments indicate signs of softening at the end of September and into October, with inflation and interest rates the big unknowns on how consumers react, and the resulting timing and depth of forecast slowdowns across industry sectors.

Industrial Performance Widens Over Building Products

In my weekly Quicktake conversation with Mike Marks, founding partner of Indian River Consulting Group, we compare notes on industry sentiment (listen to our conversation in the player above). “I would say I haven’t talked to a single distributor that’s worried about the recession,” Marks said, “even in what I call the lifestyle owner operators where their sales force runs the company, not the leadership. “They’re complaining that their margins are down, because they don’t have the temerity to pass on price increases. But other than those few exceptions — and I look at that as more of a leadership issue than an economic issue — every single distributor that I’ve spoken with has their foot all the way on the gas pedal as fast as they can.

“They’re having record margins, they’re getting the growth, they all have backlog,” he says. “The comments I’m getting is that if I can get inventory, I can sell it. The other comment I’ve kind of picked up is they say, ‘I know that when the market does turn, a lot of this backlog I have is going to vaporize.’ But in the meantime, they’re saying ‘I don’t even see any early signs of things changing yet’ and they’re just going flat-out.”

Pricing & Inventory Levers

Many distributors have managed price increases effectively over the past two years to protect or expand margins. Some of my more interesting conversations recently have been the different ways in which distributors are engaging in arbitrage as supply chain issues free up, and products become available – even in seasonal products that may not sell immediately.

Some distributors are calculating margin spread and the competitive advantage they’ll realize by stocking up versus holding costs based on market demand and overall category lead times. It’s a slightly different strategic equation than the past two years as the 2023 moderating forecasts come into sharper focus.

Listen to more of this discussion in the podcast player at the top of this blog.

Related Posts

-

Mike Marks and Tom Gale examine a California lawsuit against Amazon, the broader trade practices…

-

MDM's Tom Gale and Indian River Consulting's Mike Marks discuss what's in store for distributors…

-

The latest 0.75 percentage point increase brings the Fed's benchmark interest rate to its highest…