After a difficult 2020, there is reason for optimism about the performance of the distribution market in 2021. Not only is this the gut feeling held by nearly every distributor MDM spoke with in recent weeks, but also economic benchmark data are pointing in the direction of a continued recovery.

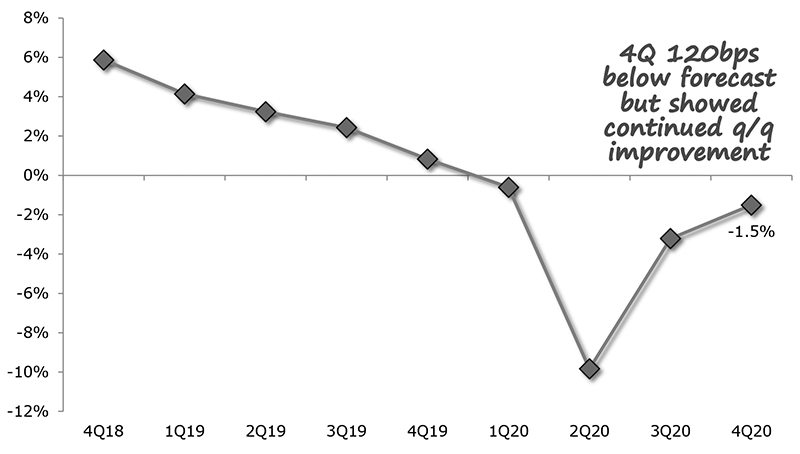

According to the latest quarterly MDM-Baird Industrial Distribution Survey, the market has shown improvement each quarter since its dramatic COVID-19-induced dip in 2Q 2020. Down 10% year over year in the spring of 2020, it ended 4Q 2020 down just 1.5% below forecast. In fact, the best performing markets were up in the fourth quarter:

- HVAC +6.2%

- LBM +5.8%

- Roofing +4.5%

- Pool & Spa +4.1%

- Safety +4%

- Landscape Supplies +3.6%

- Plumbing +3%

- Waterworks Products +2.8%

As David Manthey, senior research analyst at Baird, puts it, “We’re fighting our way back.”

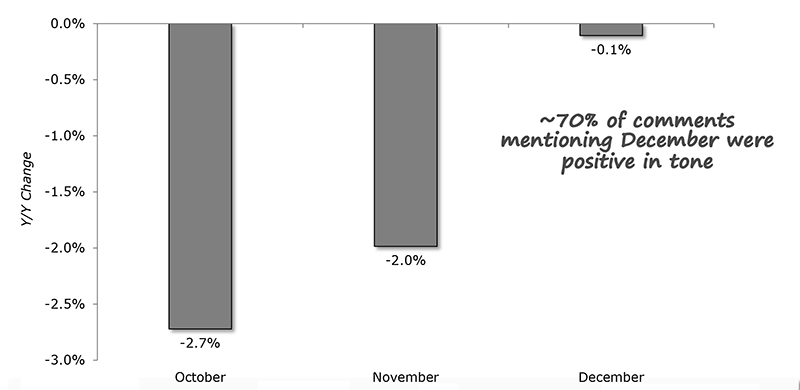

Broken down further by each month in the last quarter of 2020, the recovery becomes clearer. While October was down -2.7% year over year, November was -2% and December was down just -0.1%.

The top-performing product categories in December include:

1) HVAC +8.1%

2) LBM +6.2%

3) Pool & Spa +5%

4) Plumbing +4.1%

5) Roofing +1.7%

The strongest 4Q forecasts were in Roofing (+5.4%), Wallboard (+5%), LBM (+4.4%), HVAC (+4.1%) and OEM Fasteners (+3.9%). However, projections were not all positive. The weakest forecasts came from FM/Jan-San (-8.6%), Hoses & Accessories (-3.4%), Industrial/Energy PVF (-1.2%), Mechanical/PT (-0.7%) and Electrical (-0.5%).

Here is a breakdown of key themes and distributor expectations in a variety of distribution sectors, according to the survey.

Industrial Market

Experiencing a strong finish to the year in December, Mechanical/PT in particular is recovering quicker than expected. Heavy manufacturing end markets are projecting a ‘flattish’ first quarter and modest growth in 2021. Expect pricing to accelerate with additional inflation likely ahead.

Distributors in the sector report:

- “While October and November were difficult months, December was our best month of the entire year.”

- “A lot of companies that I’ve talked to are looking at revamping their mechanical processes, whether they had machinery that was old or they’re re-designing it for a more efficient process.”

- “Durable goods inventories are very low. Surge in replenishment orders booked 4Q20.”

- “Revenue still climbing out of ‘COVID-ditch’ in 4Q but momentum is building.”

“Raw material costs like steel, stainless and aluminum and copper are way up… all that stuff filters right down into our COGS. More than normal, pricing seems to be going up.”

Electrical Market

While construction demand was generally solid in 4Q20, weakening backlogs could lead to challenges ahead, according to the survey. Even so,

industrial momentum is building. Pricing has moderated slightly with additional inflation likely ahead. With 1Q21 expected to accelerate sharply, the 2021 outlook is raised.

Distributors in the sector report:

- “Residential construction remains strong, and small project commercial will follow.”

- “Construction was definitely the highlight for 2020 — finished really strong in the construction market.”

- “Projects that were delayed due to COVID are being released. Other than that catch-up, we think it will be a rather tough 1H21. My backlog is 10% lower today than six months ago. We turn our backlog 3x per year so things ship 4-6 months after being booked. The simple fact is what didn’t get created in 2Q20/3Q20 will impact 1H21.”

- “Industrial business is starting to pick up so we are more optimistic than we have been.”

- “Manufacturer price increases, especially on commodities, helped top-line revenue but increased margin pressure.”

- “Copper & PVC continue to rise driving good profitability.”

- “Continued to improve each month. December exceeded our expectations and we enter 1Q21 feeling positive.”

HVAC/Plumbing Market

Supply constraints are easing for HVAC OEM.

Residential HVAC demand remains strong, but the commercial market is still soft. Strong residential construction and renovation demands are powering plumbing growth that is forecasted to be steady in the near term.

Distributors in this sector report:

- “The issues are more so on indoor products (air handlers and coils). We are doing pretty well with the outdoor stuff.”

- “Stronger than predicted demand due to weather and increased attention to comfort, ventilation, and air quality this year.”

- “Pent-up demand created by home improvement projects and renewed commercial activity.”

- “There’s some quoting activity in commercial but I really think it’s 2H21 before we start to see things recover. 2022 should be a good commercial year.”

- “Residential remodeling and construction up and commercial construction down and non-existent. Many commercial jobs put on hold, indefinitely suspended, or cancelled.”

- “Pricing remains highly competitive and margins compressed but we are lucky in that we have a lot of projects going and more on the horizon barring any COVID spikes and shut-downs.”

- “Revenue & pricing will increase due to supplier price increases. Gross margins will be challenged with increased competition, especially from online marketplaces.”

Building Products Market

Strong residential demand and favorable pricing are powering roofing growth. For lumber and building materials, there is continued de-urbanization and demand for single-family home construction. Solid home renovation spending continues amid COVID-19 in the pool & spa/landscaping supplies sector. Positive pricing momentum has wallboard/gypsum respondents optimistic about 2021.

Distributors in this sector report:

- “Price was the least consideration. When can I get it was the key question.”

- “Supply will be an issue. Demand will force pricing up and shortages.”

- “If you can get shingles, you will sell shingles.”

- “We’ve seen continued strength for us with ample in-stock items that has allowed us to pick up market share. We saw increased activity in late Q4 compared to prior years with more customers willing to accept product to ship. Demand has stayed strong in both the renovation and new construction markets where we service.”

- “We are still seeing accelerated demand and have been able to command better pricing as a result. Demand levels are outpacing production capacity, leading to longer than ‘normal’ lead times and an opportunity to reallocate marketing spend.”

- “Hard to resist price increases when very short on inventory.”

- “Residential is still high at low, low margins and commercial is undecided because of continued COVID-19 and political change that is coming. The price increases on steel and drywall are holding.”

Gases/Welding Market

Inflation is picking up in this market, with the 2021 outlook generally positive for both gases and welding hardgoods.

Distributors in this sector report:

- “Seeing price increases being announced for 2021, and occasional blips in the supply chain require extra effort and cost.”

- “Cost pressures (commodities) are escalating quickly. Tariffs, what will the new administration do? Taxes, going to go up, pressure pass on price increases will grow as the year progresses.”

- “Announcement of price adjustments for Q1 ‘21 went smoother than anticipated. Oct, Nov and December all grew nicely MOM.”

- “2021 can be a breakout year, but it WILL be different. Although we were able to adjust to the COVID impact in 2020, it is not assured that we can do the same in 2021. I also worry about the supply chain of equipment, once the surge happens. I expect a big surge in demand all at once.”

- “Better than expected year-end order activity, especially from larger accounts. Most were looking for best investment/ROI for cashflow reserves stockpiled in earlier quarters. Good sign regarding outlook for 2021, namely anticipating demand and do not want to be out-of-stock when it returns and lose business.”

Pipe, Valves & Fittings Market

Industrial/Energy PVF demand continues to recover sequentially with margins under pressure.

The Waterworks market saw a solid quarter over quarter improvement with pricing near flat.

- “Revenue came in in line with our revised estimates, with continued improvements month-to-month. Price was down slightly, and margins were slightly lower based on product mix driven by slower industrial markets.”

- “Will continue to be very unstable environment, not the least because of a new environment with more regulations and higher taxes.”

- “Lower volumes put pressure on margins as we couldn’t take fixed cost out further.”

- “Customers are using the downturn as an opportunity to renegotiate pricing and T&C’s. They are being very aggressive especially with T&C’s.”

- “Margins are still under downward pressure due to increased competition and fewer participating buyers.”

- “The biggest issue in Q4 was product availability. If manufacturers could have shipped product on order, sales would have been higher.”

- “GM’s were essentially flat on an organic basis year over year. Revenue growth driven by pricing and share gain.”

Since 2010, Robert W. Baird & Co., in partnership with Modern Distribution Management, has conducted quarterly surveys of distributors and manufacturers to gauge business trends and the outlook for the industry. The Baird-MDM quarterly survey is the deepest financial performance benchmarking analysis for industrial wholesale distribution sectors, representing more than $100 billion in aggregate annual revenue across six distribution categories. Survey participants receive a complete readout of the quarterly results. For questions or to participate, contact info@mdm.com, or Baird Research Associate Quinn Fredrickson (qfredrickson@rwbaird.com).