Supplier price increases offer profit opportunities for distributors, especially today. But too often firms miss the boat. Here's a primer on the key levers and strategies to make sure everyone on your team maintains price integrity.

MDM has frequently and carefully noted that growth for most distribution sectors is slowing down. Slowing down does not mean sales are declining, just continuing to grow, but at a slower rate. At some point slower could well be a precursor to decline.

Subscribers should log-in to read this article.

Subscribers should log-in below to read this article.

Subscribers should log in below to read this article.

The following analysis examines key profit drivers in wholesale distribution across 28 lines of trade to help distributors understand the change in financial performance for the distribution industry and its segments. This article includes historical data from the past five years and trends in 2015, the latest year for which full data is available.

This article includes:

Subscribers should log in below to read this article.

Not a subscriber? Subscribe below or learn more. Subscribers also have access to the following related articles:

After following a yo-yo pattern in the wake of the Great Recession, distributor performance appears to have leveled off. The following analysis by Al Bates, director of research for Profit Planning Group and principal of the Distribution Performance Project, examines key profit drivers in wholesale distribution across 31 lines of trade. This article includes historical data from the past five years and trends in 2014, the latest year for which full data is available.

This article includes:

Subscribers should log in below to read this article.

Not a subscriber? Subscribe below or learn more. Subscribers also have access to the following related articles:

The following analysis by longtime industry expert Al Bates examines key profit drivers in wholesale distribution across 34 lines of trade monitored by the Profit Planning Group. This article looks at historical data from the past five years, and particularly trends in 2013, the last year for which full data is available. In 2013, distributors, as a group, experienced slowing sales growth, which led to an increase in expenses as a percent of sales, but also saw a slight rise in profitability.This article provides insight into this trend and provides recommendations to improve profitability in 2015.

This article includes:

Subscribers should log-in below to read this article.

Not a subscriber? Subscribe below or learn more. Subscribers also have access to the following related articles:

In 2012, distributors experienced strong growth, but that growth did not necessarily translate into strong profits. This article, provided by long-time industry expert Al Bates, provides insight into this trend and provides recommendations to improve profitabiltiy.

This analysis looks at historical data from the past five years and particular trends in 2012, the last year for which full data is available.

This article includes:

Subscribers should log-in below to read this article.

Not a subscriber? Subscribe below or learn more. Subscribers also have access to the following related articles:

The following analysis by long-time industry expert Al Bates examines key profit drivers in wholesale distribution across 40 lines of trade monitored by the Profit Planning Group. This article looks at historical data from the past five years, and particularly trends in 2011, the last year for which full data is available. The pattern that year is a marked deviation from what was seen in previous business cycles.

This article provides insight into this trend and provides recommendations to improve profitability, including the single most important issue distributors should address in 2013.

Bates is author of Triple Your Profit!, available from MDM at www.mdm.com/tripleyourprofit.

Prior to 2011, distribution firms followed a somewhat predictable pattern in relationship to the economy. As the economy entered a recession, sales and profits tumbled. Coming out of the recession, both sales and profits improved dramatically. This pattern changed in 2011 (the last year for which information is available). Sales increased sharply, but profits did not. To understand why, it is necessary to examine the key profit drivers of distribution – the factors that put profit on the bottom line the quickest.

The key profit drivers in distribution are:

The following analysis by long-time industry expert Al Bates examines key profit drivers in wholesale distribution across 40 lines of trade monitored by the Profit Planning Group. The pattern seen in 2010 is very close to what has been demonstrated in previous business cycles. This article benchmarks these key drivers and provides insight into the impact changes in each of these areas may have on distributors’ bottom lines.

Al Bates is author of Triple Your Profit! Stop Being a Profit Soldier and Start Being a Profit Winner, available now at www.mdm.com/tripleyourprofit.

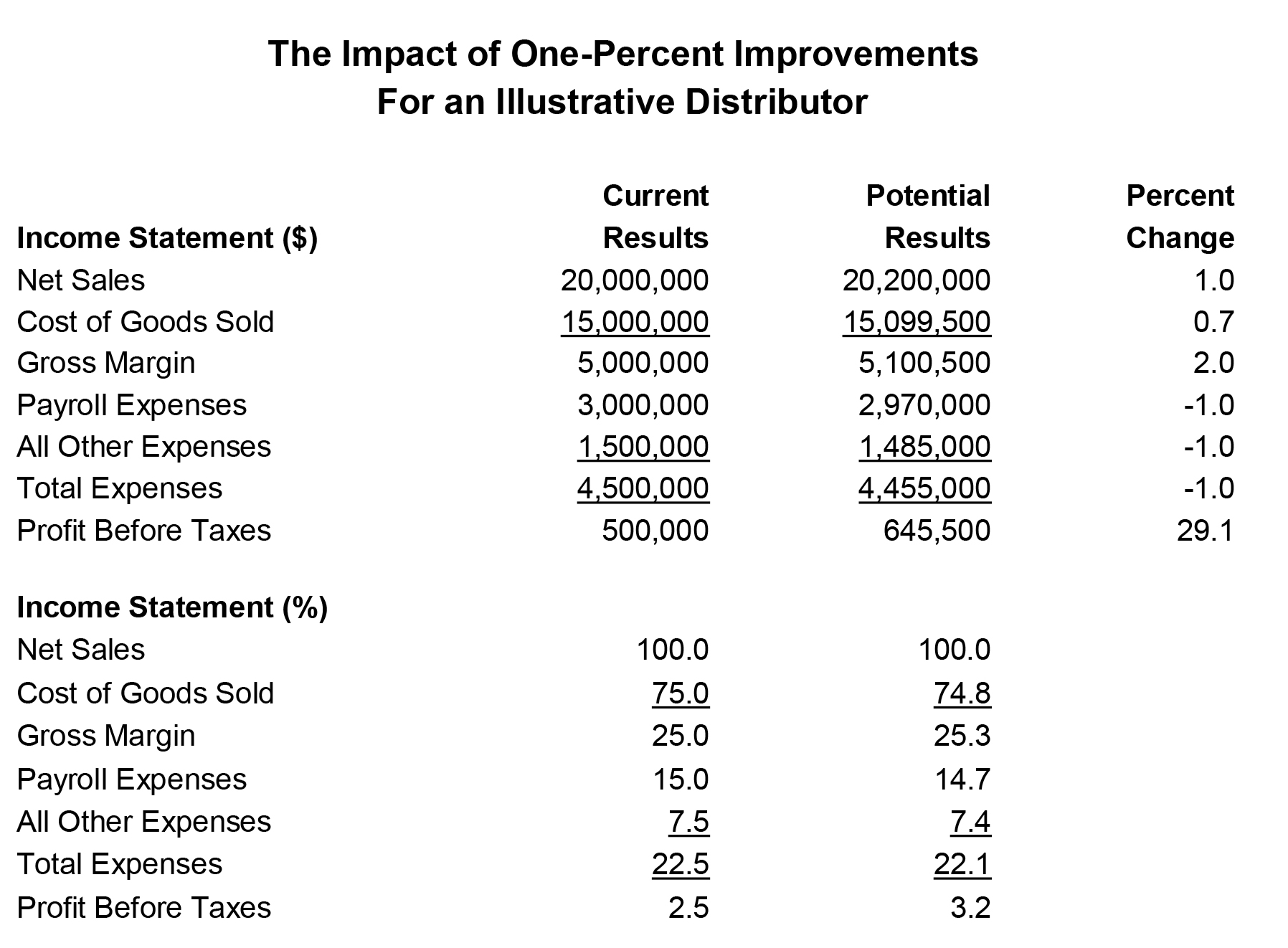

To maximize your profitability, you must set priorities based on what drives dollars to the bottom line the quickest.

Key profit drivers most important to improving your financial results include:

Sales – Increasing sales volume without increasing fixed expenses.

Fixed Expenses – Reducing the level of fixed expenses without …

In this article, Profit Planning Group's Al Bates illustrates how top companies across sectors were able to deliver strong profit results relative to their peers during the recession. He explains the four profit drivers that often are the differences between typical and high-profit firms, and with that data, he shows what typical companies can do to recession-proof their firms.

The so-called Great Recession created a unique set of financial challenges for distributors. In many lines of trade, sales didn't just decline, they fell precipitously. Overall, profits sank to the lowest point since distributor financial benchmarking was established in the 1970s.

Despite the challenges, a large number of firms continued to generate strong profits. A few even produced exceptional results. Understanding how they did that is essential …

Every year the Profit Planning Group prepares an analysis of distribution financial performance for its financial benchmarking clients. The company prepared a summary of the finding exclusively for readers of Modern Distribution Management. The information focuses on 2008, which is the last year for which complete financial information is available.

Given recent economic turbulence, 2008 may seem like ancient history. But the financial results for 2008 provide useful insights for distributors and their suppliers. They provide a clear picture of how firms responded to economic challenges. They also reflect the limits of such data.

This analysis covers 40 lines of trade in distribution. The results for distribution are divided into three groups:

By providing your email, you agree to receive announcements from us and our partners for our newsletter, events, surveys, and partner resources per MDM Terms & Conditions. You can withdraw consent at any time.

Wholesale distribution news and trends delivered right to your inbox.

Sign-up for our free newsletter and get: