As far as the pace of mergers and acquisitions, the distribution sector may have hit a Thanksgiving hangover.

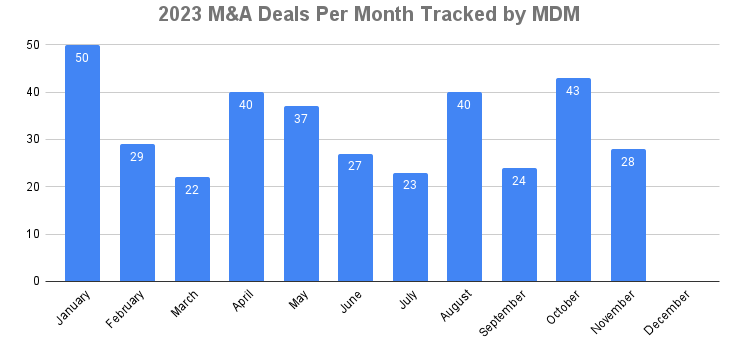

Though not entirely surprising, the volume of M&A news that MDM published during November was churning right along before turkey day in the U.S. — with 26 such deals covered through Nov. 22, but we didn’t see another deal until the last day of the month. A pair of acquisitions on Nov. 30 brought the month’s total to 28. That’s certainly still a healthy month by recent historical standards, but a considerable downshift from the 40 deals covered in October.

With November in the books, MDM has now tallied 363 total mergers and acquisitions through the first 11 months of the year, or 33.0 per month. That’s already blown away 2022’s final tally of 261 total deals at a pace of 21.9 per month.

Time will tell if this post-Thanksgiving M&A lull holds through December, or if it’s just a brief pause. December 2022 posted 24 deals.

As for November activity, we saw several distributors make multiple deals. BradyIFS + Envoy Solutions, fresh off closing their landmark merger at the end of October, didn’t miss a beat this past month, making a pair of acquisitions. Singer Industrial (formerly SBP Holdings), Motion & Control Enterprises and Core & Main likewise each announced two transactions. Meanwhile, manufacturer United Flow Technologies announced a trio of acquisitions all at once.

Read about all the deals from November by clicking the links below. Here are our roundups for October and September.

Don’t forget: MDM Premium members can download and read our 3Q 2023 M&A Report here.

November M&A Roundup

These are the M&A announcements — primarily involving distributors, but also manufacturers that sell through the channel — relevant to the industrial, commercial and building supply markets MDM covers — that we published during November 2023. For the most part, they are in reverse chronological order. Click the headline to see our news brief on each item.

Core & Main to Acquire HDPE Distributor Lee Supply: Lee Supply Company is a specialty distributor and fabricator of high-density polyethylene pipe and other related services, based in Charleroi, Pennsylvania.

Facility Monitoring Supplier RLE Technologies Privately Acquired: Acquired by May River Capital, RLE (Fort Collins, Colorado) designs and manufactures environmental monitoring equipment for data centers, critical facilities and other applications. The company serves a longstanding customer base of blue-chip OEMs, distributors, value-added reseller partners and end users.

BradyIFS + Envoy Grow Again, Acquire Sierra Packaging: The combined company announced Nov. 22 that it has acquired Sierra Supply & Packaging (Sierra Packaging Inc.), which serves the east Texas market from a solo location just west of Tyler, Texas. Sierra is a distributor of JanSan, production, packaging, safety and office supplies.

Home Depot to Add Contractor Design-Oriented Distributor: The DIY retailer said Nov. 20 that it is set to acquire International Designs Group, a platform company that owns and operates surface, appliance, and architectural specialty products distributor Construction Resources and other design-oriented subsidiaries.

MiddleGround Combines Distributors Banner Industries, Castle Metals: Private equity firm MiddleGround Capital announced Nov. 21 that it had closed on a new fund vehicle, MiddleGround Carbon CV, L.P., which provided the firm with the funds to purchase metals distributors Banner Industries and A.M. Castle & Co. (known as Castle Metals), which MiddleGround is merging into a combined entity.

United Flow Technologies Expands in Water/Wastewater with 3 Acquisitions: The H.I.G. portfolio company announced Oct. 5 that it has acquired three providers of products and services to the municipal water and wastewater markets throughout the United States: Kodru-Mooney, Macaulay Controls Company and Iowa Pumps Works.

SRS Distribution Acquires Natural Stone Supplier in TX: Marking its fourth deal of the year, RS has added Worldwide Rock Enterprises (Rock Materials), a wholesale distributor of natural and architectural cut stone, manufactured stone, cast stone, and masonry supplies.

ERIKS North America Acquires Branham Corp.: ERIKS announced Nov. 15 that it has acquired Louisville, Kentucky-based Branham Corporation, which is a fabricator and distributor of industrial hoses, gaskets, conveyor belts and related services.

NSI Expands Electrical Unit, Acquires Cast Products: Founded in 1966, Norridge, Illinois-based manufacturer and supplier Cast Products has become a recognized leader in the zinc die casting industry.

BradyIFS & Envoy Solutions Acquire Qualmax: Announced just two weeks after the closing of BradyIFS and Envoy’s merger, the combined company added Qualmax, which serves the New Jersey, New York, Pennsylvania and Connecticut marketplaces.

ABC Supply Acquires John S. Wilson Lumber in Maryland: The John S. Wilson Lumber Company location ABC acquired in West Friendship, Maryland will operate as an ABC Supply location offering roofing, siding, decking, windows and related trim products.

PIP Acquires Final Fit Safety: An Odyssey Investment Partners portfolio company, Los Angeles-based Final Fit has 35 locations worldwide. Its products are led by their BioSoft and Pinch Fit ear plugs made from biobased sustainable materials.

Core & Main to Acquire Granite Water Works in MN: Granite is a distributor of water, wastewater and storm drainage products, catering to contractors and municipalities in central Minnesota.

Resin Distributor Formerra Expands in Mexico: The addition of Mexico City-based Suministro de Especialidades broadens Formerra’s portfolio of elastomers, adhesives and other performance additives, and expands capabilities in Mexico.

The Building Center Acquires Contractors Building Supply: Building materials distributor The Building Center has acquired Contractors Building Supply, Inc. and its locations in Monroe and Ocean Isle Beach, North Carolina.

MC Distributor Aberdeen Dynamics Makes 1st Acquisition: Tulsa, Oklahoma-based motion control products distributor Aberdeen Dynamics acquired Industrial Specialties Inc. in early November. It was the first-ever acquisition for the company.

DXP Enterprises Acquires Alliance Pump in Missouri: Alliance is a municipal and industrial pump sales, service and repair company operating out of a single location in Independence, Missouri.

Henkel Acquires MRO Supplier Critica Infrastructure: Adhesives, sealants and functional coatings supplier Henkel Adhesive Technologies has acquired Houston-based Critica Infrastructure, a specialized supplier of MRO composite solutions.

Imperial Dade Acquires Advance Shipping Supplies in Canada: Mississauga, Ontario-based Advance has been a distributor of industrial supplies, packaging materials and JanSan products since 1985, serving the Ontario market.

Beacon Acquires H&H Roofing, Posts 3Q Results: Bakersfield, California-based H&H marked Beacon’s ninth acquisition of 2023.

NEFCO Acquires Edge Construction Supply in Spokane: East Hartford, Connecticut-based fasteners and construction supply distributor NEFCO entered into the Pacific Northwest with by acquiring commercial and industrial equipment supplier Edge Construction Supply (Spokane, Washington).

Singer Industrial Adds Hotsy Equipment’s CO & WY Unit: Hotsy Equipment of Colorado and Wyoming (Greeley, Colorado) sells and services industrial pressure washing equipment, infrared heaters and waste oil heaters in several key markets including agriculture, construction, municipality and general industrial supply.

Purvis Expands in Ohio, Acquires Torque Drives: With branches in North Canton and Youngstown, Ohio, Torque Drives distributes power transmission components, AC and DC drives and motors, motion control products, and material handling components.

MCE Completes 6th & 7th Acquisitions of 2023: On Nov. 1, Motion & Control Enterprises announced the acquisitions of Buford, Georgia-based Applied Industrial Controls and Engineered Systems Group. Applied is a distributor of motors, drives, and controls for industrial and municipal customers in Georgia, South Carolina, North Carolina, Alabama, Tennessee, and Florida. Engineered is a systems integrator and panel shop providing engineering, programming, and systems integration services.

Endries International Acquires Viscan Group in Quebec: Viscan is a supplier of specialized screws, general fasteners and related components. The deal marked Endries’ first in 2023 after it made three acquisitions in 2022.

Singer Industrial Continues Deal Spree, Adds Viking Hose: Randleman, North Carolina-based Viking provides industrial and hydraulic hoses and fittings to agriculture and industrial markets in North Carolina.

What’d We Miss?

Of course, it’s highly unlikely that the list above encompasses EVERY M&A deal announced during November for relevant distributors and manufacturers. There will always be deals that weren’t on our radar. If you don’t see one here you think should be included, please let us know at editor@mdm.com.

Related Posts

-

MDM reported on 40 mergers and acquisitions among industrial distributors and manufacturers in August, the…

-

The 2023 NAFCD + NBMDA Annual Convention will be held in Colorado Springs, Colorado, from…

-

The distributor also announced a new leader for its Industrial Parts and Engineered Repair Services…